Order Notice To Withhold Income For Child Support

ADVERTISEMENT

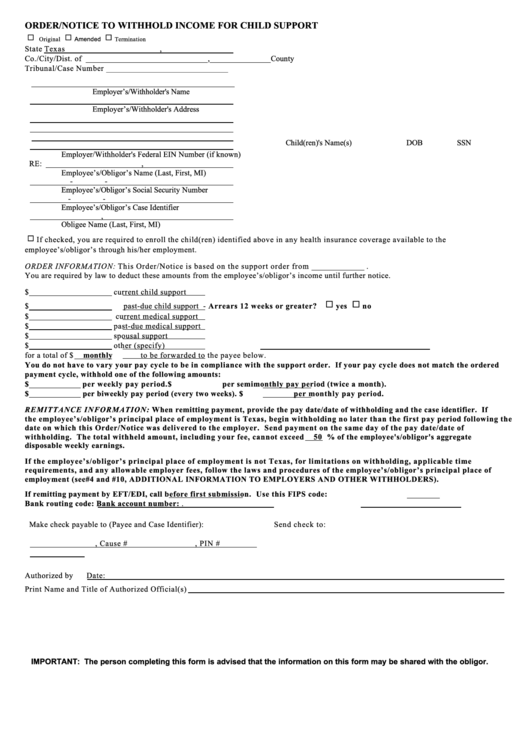

ORDER/NOTICE TO WITHHOLD INCOME FOR CHILD SUPPORT

Original

Amended

Termination

State

Texas

,

Co./City/Dist. of ______________________________,_______________County

Tribunal/Case Numb er ______________________________

__________________________________________________

Employer’s/Withholder's Name

Employer’s/Withholder's Address

Child(ren)'s Name(s)

DOB

SSN

Employer/Withholder's Federal EIN Number (if known)

RE :

,

Employee’s/Obligor’s Name (Last, First, MI)

-

-

Employee’s/Obligor’s Social Security Number

-

-

Employee’s/Obligor’s Case Identifier

,

Obligee Name (Last, First, MI)

If checked, you are required to enroll the child(ren) identified above in any health insurance coverage available to the

emp loyee’s/o bligor’s through his/her emp loyment.

ORDER INFORMATION: This Order/Notice is based on the support order from _____________ .

Yo u are re quired by law to deduct these amou nts from the employee’s/obligor’s income until further notice.

$

current child support

$

past-due child supp ort - Arrears 12 weeks or greater?

yes

no

$

current medical support

$

past-due medical support

$

spousal support

$

other (specify)

for a total of $

mon thly

to be forwarded to the payee below.

You do not have to vary yo ur pay cycle to be in compliance with the support order. If your pay cycle does not match the ordered

payment cy cle, withh old one of the fo llowing amounts:

$

per weekly pay period.

$

per semimonthly pa y period (tw ice a month).

$

per b iwe ekly p ay p eriod (every tw o w eeks).

$

per monthly pay period.

REMITTANCE INFORMATION: W hen remitting pa ymen t, provide the pa y date /date of w ithholding and the case identifier. If

the employee’s/obligor’s principal place of employment is Texas, begin withholding no later than the first pay period following the

date on which this Order/Notice was delivered to the employer. Send payment on the same day of the pay date/date of

withholding. The total withheld amount, including your fee, cannot exceed

50 % of the employee's/obligor's aggrega te

disposable w eekly earnings.

If the employee’s/obligor’s principal place of employment is not Texas, for limitations on withholding, applicable time

requirements, and any allowable employer fees, follow the laws and procedures of the employee’s/obligor’s principal place of

employmen t (see#4 and #1 0, AD DITIO NA L INF OR M ATIO N TO EM PLO YER S AN D O TH ER W ITHH OL DER S).

If rem itting p aym ent b y EFT /ED I, call

before first submission. Use this FIPS code:

Ban k routing code:

Ban k account nu mber:

.

Make check payab le to (P ayee and C ase Id entifier):

Send check to:

, Cause #

, PIN #

Autho rized by

Date:

Print Name and T itle of Authorized Official(s)

IMPORTANT: The person completing this form is advised that the information on this form may be shared with the obligor.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2