401k Fee Disclosure Worksheet

ADVERTISEMENT

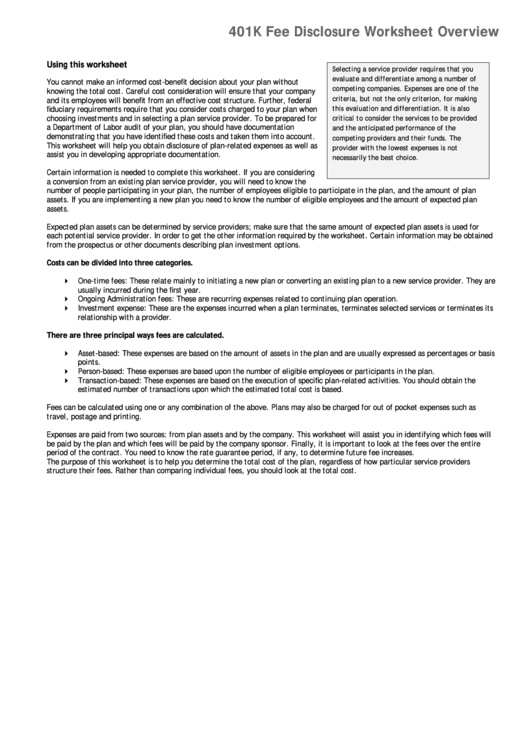

401K Fee Disclosure Worksheet Overview

Using this worksheet

Selecting a service provider requires that you

evaluate and differentiate among a number of

You cannot make an informed cost-benefit decision about your plan without

competing companies. Expenses are one of the

knowing the total cost. Careful cost consideration will ensure that your company

criteria, but not the only criterion, for making

and its employees will benefit from an effective cost structure. Further, federal

this evaluation and differentiation. It is also

fiduciary requirements require that you consider costs charged to your plan when

choosing investments and in selecting a plan service provider. To be prepared for

critical to consider the services to be provided

a Department of Labor audit of your plan, you should have documentation

and the anticipated performance of the

demonstrating that you have identified these costs and taken them into account.

competing providers and their funds. The

This worksheet will help you obtain disclosure of plan-related expenses as well as

provider with the lowest expenses is not

assist you in developing appropriate documentation.

necessarily the best choice.

Certain information is needed to complete this worksheet. If you are considering

a conversion from an existing plan service provider, you will need to know the

number of people participating in your plan, the number of employees eligible to participate in the plan, and the amount of plan

assets. If you are implementing a new plan you need to know the number of eligible employees and the amount of expected plan

assets.

Expected plan assets can be determined by service providers; make sure that the same amount of expected plan assets is used for

each potential service provider. In order to get the other information required by the worksheet. Certain information may be obtained

from the prospectus or other documents describing plan investment options.

Costs can be divided into three categories.

One-time fees: These relate mainly to initiating a new plan or converting an existing plan to a new service provider. They are

usually incurred during the first year.

Ongoing Administration fees: These are recurring expenses related to continuing plan operation.

Investment expense: These are the expenses incurred when a plan terminates, terminates selected services or terminates its

relationship with a provider.

There are three principal ways fees are calculated.

Asset-based: These expenses are based on the amount of assets in the plan and are usually expressed as percentages or basis

points.

Person-based: These expenses are based upon the number of eligible employees or participants in the plan.

Transaction-based: These expenses are based on the execution of specific plan-related activities. You should obtain the

estimated number of transactions upon which the estimated total cost is based.

Fees can be calculated using one or any combination of the above. Plans may also be charged for out of pocket expenses such as

travel, postage and printing.

Expenses are paid from two sources: from plan assets and by the company. This worksheet will assist you in identifying which fees will

be paid by the plan and which fees will be paid by the company sponsor. Finally, it is important to look at the fees over the entire

period of the contract. You need to know the rate guarantee period, if any, to determine future fee increases.

The purpose of this worksheet is to help you determine the total cost of the plan, regardless of how particular service providers

structure their fees. Rather than comparing individual fees, you should look at the total cost.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4