Payroll Withholding Tax Form - City Of Auburn

ADVERTISEMENT

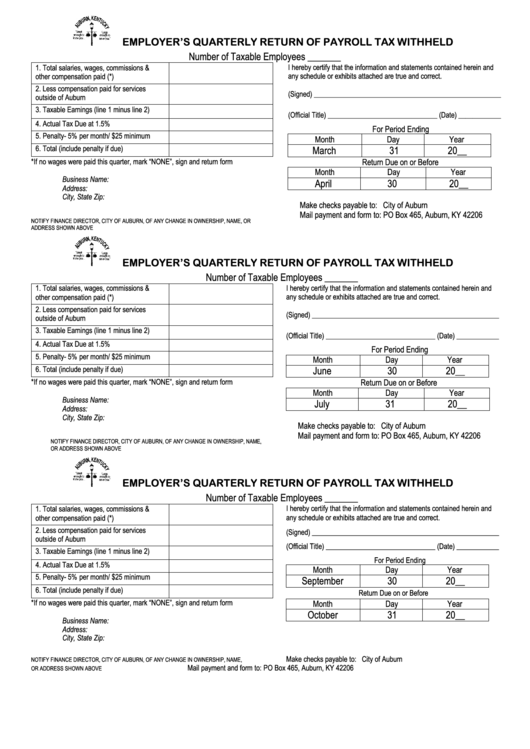

EMPLOYER’S QUARTERLY RETURN OF PAYROLL TAX WITHHELD

Number of Taxable Employees _______

1. Total salaries, wages, commissions &

I hereby certify that the information and statements contained herein and

any schedule or exhibits attached are true and correct.

other compensation paid (*)

2. Less compensation paid for services

(Signed) _____________________________________________________

outside of Auburn

3. Taxable Earnings (line 1 minus line 2)

(Official Title) _______________________________ (Date) ____________

4. Actual Tax Due at 1.5%

For Period Ending

5. Penalty- 5% per month/ $25 minimum

Month

Day

Year

6. Total (include penalty if due)

March

31

20__

*If no wages were paid this quarter, mark “NONE”, sign and return form

Return Due on or Before

Month

Day

Year

Business Name:

April

30

20__

Address:

City, State Zip:

Make checks payable to: City of Auburn

Mail payment and form to: PO Box 465, Auburn, KY 42206

NOTIFY FINANCE DIRECTOR, CITY OF AUBURN, OF ANY CHANGE IN OWNERSHIP, NAME, OR

ADDRESS SHOWN ABOVE

EMPLOYER’S QUARTERLY RETURN OF PAYROLL TAX WITHHELD

Number of Taxable Employees _______

I hereby certify that the information and statements contained herein and

1. Total salaries, wages, commissions &

any schedule or exhibits attached are true and correct.

other compensation paid (*)

2. Less compensation paid for services

(Signed) _____________________________________________________

outside of Auburn

3. Taxable Earnings (line 1 minus line 2)

(Official Title) _______________________________ (Date) ____________

4. Actual Tax Due at 1.5%

For Period Ending

5. Penalty- 5% per month/ $25 minimum

Month

Day

Year

6. Total (include penalty if due)

June

30

20__

*If no wages were paid this quarter, mark “NONE”, sign and return form

Return Due on or Before

Month

Day

Year

Business Name:

July

31

20__

Address:

City, State Zip:

Make checks payable to: City of Auburn

Mail payment and form to: PO Box 465, Auburn, KY 42206

NOTIFY FINANCE DIRECTOR, CITY OF AUBURN, OF ANY CHANGE IN OWNERSHIP, NAME,

OR ADDRESS SHOWN ABOVE

EMPLOYER’S QUARTERLY RETURN OF PAYROLL TAX WITHHELD

Number of Taxable Employees _______

I hereby certify that the information and statements contained herein and

1. Total salaries, wages, commissions &

any schedule or exhibits attached are true and correct.

other compensation paid (*)

2. Less compensation paid for services

(Signed) _____________________________________________________

outside of Auburn

(Official Title) _______________________________ (Date) ____________

3. Taxable Earnings (line 1 minus line 2)

For Period Ending

4. Actual Tax Due at 1.5%

Month

Day

Year

5. Penalty- 5% per month/ $25 minimum

September

30

20__

6. Total (include penalty if due)

Return Due on or Before

*If no wages were paid this quarter, mark “NONE”, sign and return form

Month

Day

Year

October

31

20__

Business Name:

Address:

City, State Zip:

Make checks payable to: City of Auburn

NOTIFY FINANCE DIRECTOR, CITY OF AUBURN, OF ANY CHANGE IN OWNERSHIP, NAME,

Mail payment and form to: PO Box 465, Auburn, KY 42206

OR ADDRESS SHOWN ABOVE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2