Zero Occupancy Discount Form Highland Council

ADVERTISEMENT

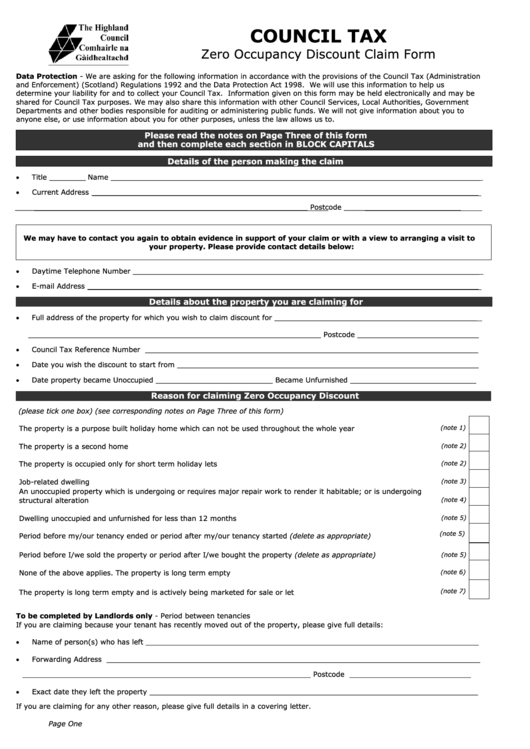

COUNCIL TAX

Zero Occupancy Discount Claim Form

Data Protection - We are asking for the following information in accordance with the provisions of the Council Tax (Administration

and Enforcement) (Scotland) Regulations 1992 and the Data Protection Act 1998. We will use this information to help us

determine your liability for and to collect your Council Tax.

Information given on this form may be held electronically and may be

shared for Council Tax purposes. We may also share this information with other Council Services, Local Authorities, Government

Departments and other bodies responsible for auditing or administering public funds. We will not give information about you to

anyone else, or use information about you for other purposes, unless the law allows us to.

Please read the notes on Page Three of this form

and then complete each section in BLOCK CAPITALS

Details of the person making the claim

Title ________ Name __________________________________________________________________________________

Current Address ______________________________________________________________________________________

_________________________________________________________________ Postcode __________________________

We may have to contact you again to obtain evidence in support of your claim or with a view to arranging a visit to

your property. Please provide contact details below:

Daytime Telephone Number _____________________________________________________________________________

E-mail Address _______________________________________________________________________________________

Details about the property you are claiming for

Full address of the property for which you wish to claim discount for _____________________________________________

_________________________________________________________________ Postcode ___________________________

Council Tax Reference Number __________________________________________________________________________

Date you wish the discount to start from ___________________________________________________________________

Date property became Unoccupied __________________________ Became Unfurnished ____________________________

Reason for claiming Zero Occupancy Discount

(please tick one box) (see corresponding notes on Page Three of this form)

The property is a purpose built holiday home which can not be used throughout the whole year

(note 1)

The property is a second home

(note 2)

The property is occupied only for short term holiday lets

(note 2)

Job-related dwelling

(note 3)

An unoccupied property which is undergoing or requires major repair work to render it habitable; or is undergoing

structural alteration

(note 4)

Dwelling unoccupied and unfurnished for less than 12 months

(note 5)

(note 5)

Period before my/our tenancy ended or period after my/our tenancy started (delete as appropriate)

Period before I/we sold the property or period after I/we bought the property (delete as appropriate)

(note 5)

None of the above applies. The property is long term empty

(note 6)

The property is long term empty and is actively being marketed for sale or let

(note 7)

To be completed by Landlords only - Period between tenancies

If you are claiming because your tenant has recently moved out of the property, please give full details:

Name of person(s) who has left __________________________________________________________________________

Forwarding Address ___________________________________________________________________________________

________________________________________________________________ Postcode ___________________________

Exact date they left the property _________________________________________________________________________

If you are claiming for any other reason, please give full details in a covering letter.

Page One

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4