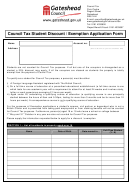

Zero Occupancy Discount Form Highland Council Page 3

ADVERTISEMENT

NOTES for the completion of the

Zero Occupancy Claim Form

The initial bill for a property assumes there are at least two permanent residents 18 years or over in the property

and a full charge for Council Tax and when applicable, Water and Wastewater is levied. While there is no extra

charge if there are more than two residents, a discount will apply where there are no permanent residents.

Second Homes or Long Term Empty Properties: If the address of your main residence is outwith Highland

Council area you should provide a copy of your Council Tax bill for that property together with other

required evidence as shown in the notes below.

1.

Purpose Built Holiday Home: A dwelling which is used for holiday purposes and which was either (a) in

accordance with any licence or planning permission regulating the use of the site, or for any other reason, is not

allowed to be used for human habitation throughout the whole year; or (b) by reason of its construction or the

facilities which it does, or does not, provide, is unfit so to be used. You should provide evidence of any planning

or site restrictions relating to the property.

2.

Second Home: A dwelling which is no one's sole or main residence, but which is furnished and in respect of

which, during any period of 12 months, the person who is liable to pay the Council Tax that is chargeable can

produce evidence to establish that it is lived in other than as a sole or main residence for at least 25 days during that

period.

If the property is available for short-term lets for 140 days or more in the year, then you should be paying Non

Domestic Rates rather than Council Tax. You could be paying too much. Please contact us for help and advice.

3.

Job-related Dwelling: A dwelling which is either (a) owned or tenanted by a person whose sole or main

residence is a dwelling which for that person is job-related or (b) a dwelling which is job-related for a person whose

sole or main residence is a dwelling which is owned or tenanted by that person. You should provide a letter from

your employer confirming this.

4.

An unoccupied property which is undergoing or requires major repair work to render it habitable; or

is undergoing structural alteration: Discount can be awarded for up to 6 months from the date of purchase of the

property. An Officer from the Council will be required to inspect the property. If you are claiming for a backdated

period you should provide evidence of the work carried out, for example a building warrant.

5.

Dwellings vacant for less than 12 months: A dwelling that is unoccupied and unfurnished for less than 12

months. The maximum period we can award 10% discount is 6 months. Discount can be awarded for up to 6 months

immediately following an unoccupied and unfurnished exemption.

6.

Long Term Empty Properties: An unoccupied property which is not a second home and has been

continuously unoccupied for a period less than 2 years and in respect of which the person who is liable to pay the

Council Tax that is chargeable can produce evidence to establish that:

a) it is being actively marketed for sale on terms and conditions, including proposed price, which are

appropriate for sale of the property; and

b) an offer to purchase at that price would be accepted by the owner.

Or

a) it is being actively marketed for let on terms and conditions, including proposed rent, which are

appropriate for let of the property; and

b) an offer to pay such rent would be likely to lead to creation of a tenancy.

If you need help and advice to complete this form please telephone 0800 393811 or visit one of our Service

Points or e-mail us at: operations.team@highland.gov.uk. Please do NOT send personal data to this email address.

Completed forms should be returned to Operations Team, The Highland Council, PO Box 5650, Inverness, IV3

5YX.

Until your claim has been dealt with, you must continue to make payment as requested in the last

bill we sent you. If we award you discount we will send you a revised bill which will include all of the payments you

have made. If you have overpaid, we will send you a cheque for the amount of the overpayment.

Working away from home: A taxpayer working away from home is still considered, for Council Tax purposes, to

have their main place of residence in the property they return to when on leave or at weekends, i.e. normally the

marital or parental home. This includes Merchant Sea personnel and persons with an Inland Revenue Tax

Exemption Certificate.

Page Three

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4