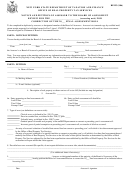

SECTION IV: SIGNATURES

PETITIONER, TAXPAYER, OR DULY AUTHORIZED EMPLOYEE OR CORPORATE OFFICER OF THE TAXPAYER

I certify that my entries in SECTION I and SECTION II are accurate to the best of my knowledge and belief. I also understand that by

appealing my assessment, my assessment may increase, may decrease, or may remain the same.

Date signed (month, day, year)

Signature of petitioner, taxpayer or duly authorized officer

Title (please print or type)

Printed or typed name of petitioner, taxpayer or duly authorized officer

TAX REPRESENTATIVE

I certify that the entries in SECTION I and SECTION II are accurate to the best of my knowledge and belief. I certify that

I have viewed this property, the property record card, and the Form 115, and that I have the authority to file this appeal on

behalf of the taxpayer. I certify that I have made all necessary disclosures to my client, pursuant to 52 IAC 1-2-2.

Date signed (month, day, year)

Signature of tax representative

Printed or typed name of tax representative

ATTORNEY REPRESENTATIVE

I certify that the entries in SECTION I and SECTION II are accurate to the best of my knowledge and belief.

Date signed (month, day, year)

Signature of attorney representative

Attorney number

Printed or typed name of attorney representative

FORM 131 CHECKLIST

I have reviewed and attached the Notification of Final Assessment Determination (Form 115)

I have attached a copy of the Form 130

I have reviewed the property record card (for Real Property appeals only)

If I am appealing both real property and personal property assessments, I have filed separate petitions for each type of property

I have checked the type of property under appeal (real or personal) on page 1

I have identified any other pending appeals for this parcel on page 1

I have attached all real property sales and appraisal information, as required by Section II

I have provided a statement and outline of the type of evidence I intend to submit (Section II)

I have explained in detail the basis for my belief that the assessment is incorrect (Section II)

I have reviewed Section III, selected a small claims option, and provided signature

If this petition is being filed by an authorized tax representative, a duly executed power of attorney and Tax Representative

Disclosure Statement is attached

I have completed Section I, Section II, Section III, and Section IV of this petition

I have signed this petition (Section IV)

If there are other related parcels currently under appeal, a listing of these parcels has been attached

Form 131, page 4

1

1 2

2 3

3 4

4