Fsa Worksheet Dependent Care

ADVERTISEMENT

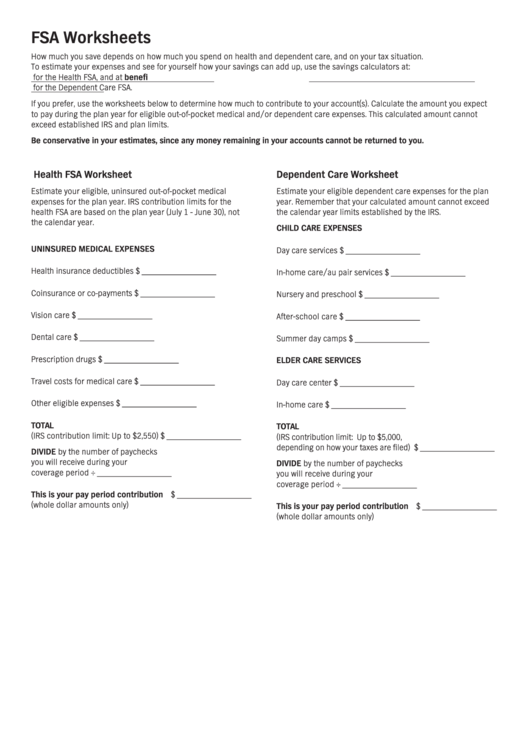

FSA Worksheets

How much you save depends on how much you spend on health and dependent care, and on your tax situation.

To estimate your expenses and see for yourself how your savings can add up, use the savings calculators at:

client .benefitadminsolutions .com/fsaestimator/ for the Health FSA, and at benefitadminsolutions .com/dcapestimator/

calculatedcap .aspx for the Dependent Care FSA.

If you prefer, use the worksheets below to determine how much to contribute to your account(s). Calculate the amount you expect

to pay during the plan year for eligible out-of-pocket medical and/or dependent care expenses. This calculated amount cannot

exceed established IRS and plan limits.

Be conservative in your estimates, since any money remaining in your accounts cannot be returned to you .

Health FSA Worksheet

Dependent Care Worksheet

Estimate your eligible, uninsured out-of-pocket medical

Estimate your eligible dependent care expenses for the plan

expenses for the plan year. IRS contribution limits for the

year. Remember that your calculated amount cannot exceed

health FSA are based on the plan year (July 1 - June 30), not

the calendar year limits established by the IRS.

the calendar year.

CHILD CARE EXPENSES

UNINSURED MEDICAL EXPENSES

Day care services

$ _________________

Health insurance deductibles

$ _________________

In-home care/au pair services

$ _________________

Coinsurance or co-payments

$ _________________

Nursery and preschool

$ _________________

Vision care

$ _________________

After-school care

$ _________________

Dental care

$ _________________

Summer day camps

$ _________________

Prescription drugs

$ _________________

ELDER CARE SERVICES

Travel costs for medical care

$ _________________

Day care center

$ _________________

Other eligible expenses

$ _________________

In-home care

$ _________________

TOTAL

TOTAL

(IRS contribution limit: Up to $2,550)

$ _________________

(IRS contribution limit: Up to $5,000,

depending on how your taxes are filed) $ _________________

DIVIDE by the number of paychecks

you will receive during your

DIVIDE by the number of paychecks

coverage period

÷ _________________

you will receive during your

coverage period

÷ _________________

This is your pay period contribution $ _________________

(whole dollar amounts only)

This is your pay period contribution $ _________________

(whole dollar amounts only)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1