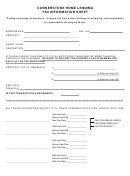

Client Tax Information Sheet Page 2

ADVERTISEMENT

Itemized Deductions

(List amounts and provide receipts, checks or other documentation.)

MEDICAL EXPENSES

INTEREST PAID

Doctors

Mortgage on Main Home

Dentists

Paid to Financial Institution (1098)

Other Medical Professionals

Paid to Individual

Prescription Drugs

Name:

SSN:

Surgical Procedures

Address:

Medical Lab Fees

Points Paid on New Mortgage

Hospitals

(Enclose Settlement Statement)

Glasses and Contact Lenses

Home Equity Loan/Second Mortgage

Medical Equipment Rental

Mortgage on Second Home

Prescribed Physical Aids

Paid to Financial Institution (1098)

Skilled Nursing Care

Paid to Individual

Medical Insurance

Name:

SSN:

Dental Insurance

Address:

Long Term Care Insurance

Investment Interest Paid

Medicare Part B

Medical Transportation

CHARITABLE CONTRIBUTIONS*

Medical Miles Driven in Your Vehicle

*Receipt required for single donations of $250 or more.

Other Medical (Describe)

Church/Temple/Mosque

United Way

Scouts

Other (list)

STATE & LOCAL TAXES

Home Real Estate Taxes

Other Real Estate Taxes

Non-Cash Contributions

Personal Property Tax (autos, boat)

(If $500 or more, enclose receipt with name/address of organization

and describe how fair market value was determined.)

Other State or Local Tax

CASUALTY OR THEFT LOSS

MISCELLANEOUS DEDUCTIONS

Type of Property:

Tax Return Preparation Fee (2006)

Describe Loss:

Safe Deposit Box (store investments)

Cost or Basis of Property

Investment Expenses (enclose list)

Insurance Reimbursement

Job Hunting Expenses (enclose list)

Fair Market Value Before Loss

Gambling Losses

Fair Market Value After Loss

Second Job Mileage

Employee Business Expenses and Miscellaneous Deductions

Prof. Association or Union Dues

$__________

Total Mileage on Vehicle in 2009

___________

Uniforms (not street clothes)

$__________

Out of Town Transportation

$__________

Uniform Cleaning

$__________

Out of Town Lodging

$__________

Safety Equipment

$__________

Office in Home Expense

Ask for form

Tools & Other Work Equipment

$__________

Job Hunting Expenses

$__________

Advertising & Marketing

$__________

Safe Deposit Box Rent

$__________

Business Meals & Entertainment

$__________

Tax Return Preparation

$__________

Business Vehicle Mileage 2009

___________

Investment Advice/Management Fee

$__________

Other ________________________ $__________

EDUCATOR AND EDUCATION EXPENSES

Educator Expense

Student Name

Student Name

Type Expense

Type Expense

Amount

$

Amount

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3