Event Income And Expense Report Template Page 2

ADVERTISEMENT

Income and Expense Sheets

We are trying to distinguish between the costs, and income, related to a single event, those that

support a discipline in general, and the costs, and income, for the club as a whole. Thus, if we pay for

transportation to the track for a specific event, it would be considered event specific. However, if we

rent porta-potties for the whole winter season, that would be considered discipline specific. Other costs

relate to running the club overall, such as bookkeeping. These will be tracked separately.

For that reason, the “loot” form is being replaced by two types of income and expense sheets forms

starting in November 2010 and moving forward. The first is event specific and is intended to capture all

the income and expenses for an event. The second will capture discipline wide or organization wide

income and expenses. The following list explains each of the fields on the form.

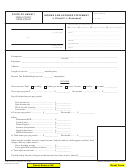

Event Income and Expense Report

Event Name and Date

This should provide enough information to allow us to connect to a specific event. If you want to report

information for multiple events, please use multiple forms.

Submitted By:

The name of the person submitting the report and anticipating payment, if required.

Date

The date that the report is complied

Number of Participants and Fee per Person including Base Fee and HST for members and non-

members

This should provide the number of each and the base and HST amounts charge for the event. The

base fee and HST should total what the person paid.

Income (excluding Karelo) including base and HST in cheques and in Cash

This is the total income received excluding what is recorded in Karelo. It should be split between the

amount in cheques and cash and be recorded showing the base amount and the amount that was HST.

Registration Fees

The total amount received for registration fees.

SWAG Sales

The total amount received for sales of SWAG. This should be matched by an expense for SWAG items.

Other Income (please describe)

If any income is received that doesn’t fit in either of the above categories, please report it here and

explain it in the notes section at the end of the page.

Total Income

The sum of the above fields.

Expenses (To Whom & For What)

This should be a clear description of what is being paid for and what person or organization should be

or has been paid.

Base and HST

The total expense amount needs to be split between the base amount and the HST that was paid.

Status

This field identifies what needs to be done or has been done about paying the expense. If it was

already paid using the income for the event, it will be I. If it was already paid using the discipline’s float,

- 2 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3