Annual Return To South Kingstown Form - R.i. Tax Assessor Page 4

ADVERTISEMENT

SECTION 9 SIGN YOUR RETURN

I do hereby certify and declare that, to the best of my knowledge and belief, the foregoing is a true and complete list of

all real estate and personal property owned by said Corporation, Co-Partnership or Individual in or ratable in said

Town/City on the said thirty-first day of December, 2015 at 12 o’clock midnight, Eastern Standard time; that the value

placed against each item thereof is the full and fair-cash value thereof at said time.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and

statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer

Please

(other than officer) is based on all information of which preparer has any knowledge.

Sign

Here

Signature

Date

Preparer’s

Date

Signature ____________________________________________

Check if

Paid

Self-Employed

Preparer’s

Phone Number

Use Only

Firm’s name (or

ZIP code

yours if self-employed) _________________________________

and address

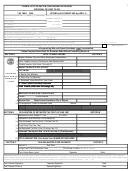

ASSESSOR’S USE ONLY

Total Section 1 ____________________

Total Section 5 ______________ __________

(Real Estate Owned)

(Buildings & Improvements on Leased Land)

Total Section 2 ____________________

Total Section 6 ________________________

(Short Life – Computer Equipment Only)

(Leased/Rented/Consigned Tangible Personal P roperty)

Total Section 3 ____________________

Total Section 7 ________________________

(Tangible Personal Property)

(Tangible Property Leased to Others)

Total Section 4 ____________________

Total Section 8 ________________________

(Long Life Assets)

(Leasehold Improvements)

GRAND TOTAL __________________________________

If you are no longer in business, please state the date the business closed and where the assets

are, then return the form to us. Failure to respond by January 31, 2016 will result in a 2016

Tax Bill.

Leasing Companies: Please provide disposition list. If you no longer hold the leases, we need

to know where the equipment went – was it sold to lessee, returned to you, other, etc.

If you want a copy of your annual return when it is processed by the Tax

Assessor or a copy of your approved request for an extension, you must provide

a self-addressed envelope with the appropriate postage.

Thank You

This form is available on our website: . Click at forms, and then scroll

to Tax Assessment. Choose “Businesses/Personal Property”.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4