Mortgage Shopping Worksheet Template

ADVERTISEMENT

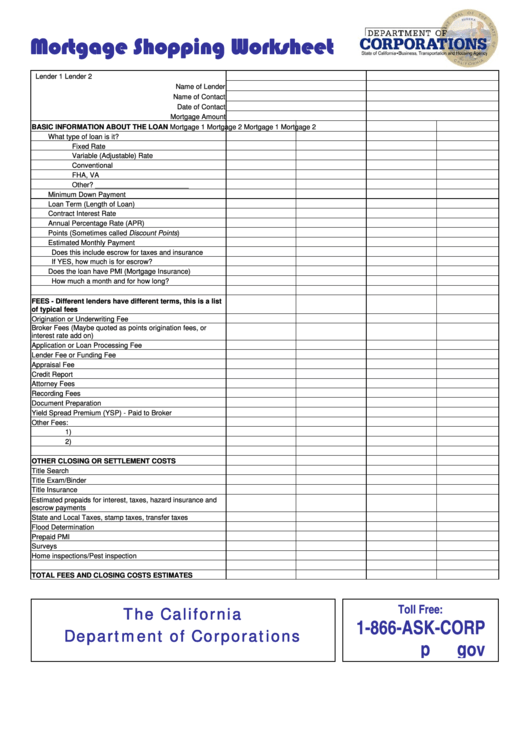

Mortgage Shopping Worksheet

Lender 1

Lender 2

Name of Lender

Name of Contact

Date of Contact

Mortgage Amount

BASIC INFORMATION ABOUT THE LOAN

Mortgage 1

Mortgage 2

Mortgage 1

Mortgage 2

What type of loan is it?

Fixed Rate

Variable (Adjustable) Rate

Conventional

FHA, VA

Other? ________________________

Minimum Down Payment

Loan Term (Length of Loan)

Contract Interest Rate

Annual Percentage Rate (APR)

Points (Sometimes called Discount Points)

Estimated Monthly Payment

Does this include escrow for taxes and insurance

If YES, how much is for escrow?

Does the loan have PMI (Mortgage Insurance)

How much a month and for how long?

FEES - Different lenders have different terms, this is a list

of typical fees

Origination or Underwriting Fee

Broker Fees (Maybe quoted as points origination fees, or

interest rate add on)

Application or Loan Processing Fee

Lender Fee or Funding Fee

Appraisal Fee

Credit Report

Attorney Fees

Recording Fees

Document Preparation

Yield Spread Premium (YSP) - Paid to Broker

Other Fees:

1)

2)

OTHER CLOSING OR SETTLEMENT COSTS

Title Search

Title Exam/Binder

Title Insurance

Estimated prepaids for interest, taxes, hazard insurance and

escrow payments

State and Local Taxes, stamp taxes, transfer taxes

Flood Determination

Prepaid PMI

Surveys

Home inspections/Pest inspection

TOTAL FEES AND CLOSING COSTS ESTIMATES

The California

Toll Free:

1-866-ASK-CORP

Department of Corporations

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2