Unemployment Tax Credit Kt 740 Page 2

Download a blank fillable Unemployment Tax Credit Kt 740 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Unemployment Tax Credit Kt 740 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

INSTRUCTIONS

Kentucky law permits an unemployment tax credit against the income tax liability of employers who hire qualified unem-

ployed Kentucky residents. The credit is $100 per qualified person hired. To qualify, the person employed must have been

officially unemployed for 60 days immediately prior to employment and must have remained employed for 180 consecutive

days during the tax year. The Education Cabinet, Office of Employment and Training must classify persons hired as being

unemployed.

A taxpayer/employer cannot claim the credit for an employee: (1) for whom the taxpayer/employer receives federally funded

payments for on-the-job training; or (2) who qualifies as a dependent of the taxpayer/employer for federal and state income

tax purposes; or (3) who is a relative of the taxpayer/employer, or an individual who owns more than 50 percent of the

outstanding stock of a corporation; or (4) if the taxpayer/employer is an estate or trust, who is a grantor, beneficiary or

fiduciary of the estate or trust, or who is a relative of the grantor, beneficiary or fiduciary.

Partnerships, S corporations, estates and trusts must pass through the unemployment tax credit pro rata to partners, share-

holders and beneficiaries. A copy of this schedule or other evidence of the credit must be furnished to the respective taxpayers.

Partners', shareholders' and beneficiaries' unemployment tax credit is limited to 90 percent of their Kentucky tax liability and

the excess may be carried back three years and forward 15 years. The limitation and credit are applied to the Kentucky income

tax liability before any prepayments or other cash payments are credited to the taxpayer's account for the taxable year.

This schedule must be attached to Form 740, 740-NP , 741, 765, 720 or 720S before credit will be allowed.

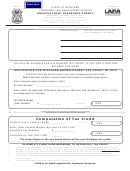

Employment Dates

Office of

Employment

Date

Date Employed

Employee's Name

Social Security Number

Employed

Through

and Training

Certificate Number

Mo. Day

Yr.

Mo. Day

Yr.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2