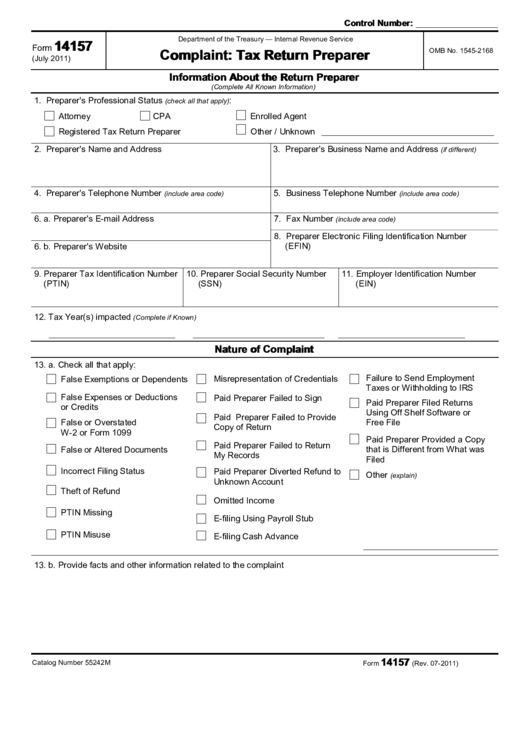

Control Number:

Department of the Treasury — Internal Revenue Service

14157

Form

OMB No. 1545-2168

Complaint: Tax Return Preparer

(July 2011)

Information About the Return Preparer

(Complete All Known Information)

1. Preparer's Professional Status

:

(check all that apply)

Attorney

CPA

Enrolled Agent

Registered Tax Return Preparer

Other / Unknown

2. Preparer's Name and Address

3. Preparer's Business Name and Address

(if different)

4. Preparer's Telephone Number

5. Business Telephone Number

(include area code)

(include area code)

6. a. Preparer's E-mail Address

7. Fax Number

(include area code)

8. Preparer Electronic Filing Identification Number

(EFIN)

6. b. Preparer's Website

9. Preparer Tax Identification Number

10. Preparer Social Security Number

11. Employer Identification Number

(PTIN)

(SSN)

(EIN)

12. Tax Year(s) impacted

(Complete if Known)

Nature of Complaint

13. a. Check all that apply:

Failure to Send Employment

False Exemptions or Dependents

Misrepresentation of Credentials

Taxes or Withholding to IRS

False Expenses or Deductions

Paid Preparer Failed to Sign

Paid Preparer Filed Returns

or Credits

Using Off Shelf Software or

Paid Preparer Failed to Provide

Free File

False or Overstated

Copy of Return

W-2 or Form 1099

Paid Preparer Provided a Copy

Paid Preparer Failed to Return

that is Different from What was

False or Altered Documents

My Records

Filed

Incorrect Filing Status

Paid Preparer Diverted Refund to

Other

(explain)

Unknown Account

Theft of Refund

Omitted Income

PTIN Missing

E-filing Using Payroll Stub

PTIN Misuse

E-filing Cash Advance

13. b. Provide facts and other information related to the complaint

14157

Catalog Number 55242M

Form

(Rev. 07-2011)

1

1 2

2 3

3 4

4 5

5