(

)

(

)

(

)

R-3318 (11/08)

Schedule IV – Tax Reduction and Determination of Louisiana Estate Transfer Tax

Total state death tax credit allowable (Per U.S. Federal Estate Tax Return Form 706)

1

$

Ratio of assets attributable to Louisiana (Louisiana gross estate to federal gross estate, per federal return)

2

State death tax credit attributable to Louisiana (Multiply Line 1 by Line 2.)

3

Basic inheritance tax (From Schedule III)

4

Tax reduction under Act 818 of 1997 (See instructions.)

5

%

Inheritance tax reduction (Multiply Line 4 by Line 5.)

6

Inheritance tax due (Subtract Line 6 from Line 4.)

7

Louisiana estate transfer tax (Subtract Line 7 from Line 3; if less than zero, enter zero.)

8

$

Schedule V – Summary of Inheritance Tax, Estate Transfer Tax, and Interest Due

1

Inheritance tax due (From Line 7, Schedule IV)

$

2

Estate transfer tax (From Line 8, Schedule IV)

3

Interest due on inheritance and estate transfer taxes (See instructions.)

4

Total amount due (Add Lines 1 through 3.)

5

Previous remittance

6

Balance due or refund requested (Subtract Line 5 from Line 4.)

$

Executors and Administrators (including Ancillary Executors and Administrators)

Name

Designation and Social Security Number

Address

City

State

ZIP

Name

Address

City

State

ZIP

Declaration

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to the best of my knowledge and

belief, it is true, correct, and complete. If the return is prepared by persons other than the taxpayer, their declaration is based on all the information relating

to the matters required to be reported in the return of which they have knowledge.

Date (mm/dd/yyyy)

Signature of attorney

Address (Number and street, city, state, ZIP)

Telephone

Date (mm/dd/yyyy)

Signature of preparer (if other than attorney)

Address (Number and street, city, state, ZIP)

Telephone

Date (mm/dd/yyyy)

Signature of Executor/Administrator

Telephone

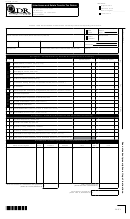

Table I - American Experience Mortality Table (Louisiana Revised Statute 47:2405)

Life

PV of Naked

PV of Life

Life

PV of Naked

PV of Life

Life

PV of Naked

PV of Life

Age

Age

Age

Expectancy

Ownership

Usufruct

Expectancy

Ownership

Usufruct

Expectancy

Ownership

Usufruct

.085548

.914452

23.81

.249794

.750206

7.55

.644352

.355648

20

42.20

46

72

41.53

.089967

.910033

23.08

.260612

.739388

7.11

.660916

.339084

21

47

73

40.85

.092544

.907456

22.36

.271850

.728150

6.68

.677826

.322174

22

48

74

40.10

.096672

.903328

21.63

.283666

.716334

6.27

.694187

.305813

23

49

75

39.49

.100197

.899803

20.91

.295743

.704257

5.88

.710037

.289963

24

50

76

38.81

.104231

.895769

20.20

.308275

.691725

5.49

.726532

.273468

25

51

77

38.12

.108497

.891503

19.49

.321346

.678654

5.11

.742605

.257395

26

52

78

37.43

.112975

.887025

18.79

.334678

.665322

4.74

.758915

.241085

27

53

79

36.73

.117669

.882331

18.09

.348559

.651441

4.39

.774608

.225392

28

54

80

36.03

.122533

.877467

17.40

.362956

.637044

4.05

.789852

.210148

29

55

81

35.33

.127675

.872325

16.73

.377380

.622620

3.71

.805876

.194124

30

56

82

34.63

.132994

.867006

16.05

.392532

.607468

3.39

.821084

.178916

31

57

83

32

33.93

.138491

.861509

58

15.39

.408054

.591946

84

3.06

.835817

.164183

33.21

.144448

.855552

14.74

.423774

.576226

2.77

.851206

.148794

33

59

85

34

32.50

.150571

.849429

60

14.10

.439797

.560203

86

2.47

.866319

.133681

31.78

.157003

.842997

13.47

.456366

.543634

2.18

.880928

.119072

35

61

87

31.07

.163604

.836396

12.86

.472777

.527223

1.91

.894442

.105558

36

62

88

30.35

.170661

.829339

12.26

.489655

.510345

1.66

.908152

.091848

37

63

89

29.62

.178080

.821920

11.67

.506809

.493191

1.42

.920968

.079032

38

64

90

28.90

.185664

.814336

11.10

.523806

.476194

1.19

.933250

.066750

39

65

91

28.18

.193637

.806363

10.54

.541327

.458673

0.98

.944528

.055472

40

66

92

27.45

.202086

.797914

10.00

.558395

.441605

0.80

.954717

.045283

41

67

93

26.22

.217073

.782927

9.47

.576152

.423848

0.64

.963773

.036227

42

68

94

26.00

.219810

.780190

8.97

.592963

.407037

0.50

.971698

.028302

43

69

95

25.27

.229438

.770562

8.48

.610365

.389635

44

70

24.54

.239430

.760570

8.00

.627412

.372588

45

71

Table II - Exemption and Tax Rates

Classification of heirs or legatees

Exemption

Rate of tax

Deaths in calendar year:

1983 and prior years - $5,000 each

See instructions on tax rate.

1984 - $10,000 each

Direct descendants by blood or affinity, ascen-

1985 - $15,000 each

2% of the actual value on the first $20,000 tax-

dant, or surviving spouse of decedent

1986 - $20,000 each

able, plus 3% of the actual value in excess of

1987 and thereafter - $25,000 each

$20,000

1992 and thereafter - surviving

spouse totally exempt

5% of the actual value on the first $20,000 tax-

Collateral relations (including brothers or sisters

$1,000 each

able, plus 7% of the actual value in excess of

by affinity)

$20,000

5% of the actual value on the first $5,000 taxable,

Strangers or nonrelated persons

$500 each

plus 10% of the actual value in excess of $5,000

Charitable, religious, or educational organizations

Totally exempt

1402

1

1 2

2