Sales, Sellers Use, Consumers Use & Rental Tax Report Form

ADVERTISEMENT

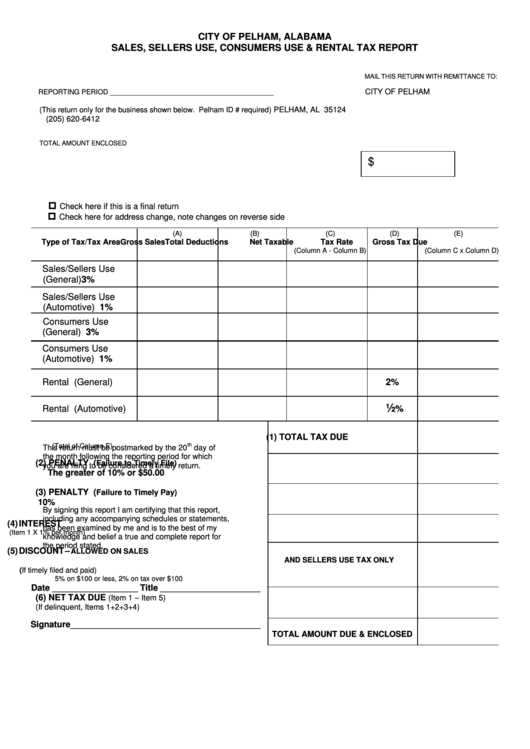

CITY OF PELHAM, ALABAMA

SALES, SELLERS USE, CONSUMERS USE & RENTAL TAX REPORT

MAIL THIS RETURN WITH REMITTANCE TO:

CITY OF PELHAM

REPORTING PERIOD __________________________________________

P.O. BOX 1238

(This return only for the business shown below. Pelham ID # required)

PELHAM, AL 35124

(205) 620-6412

TOTAL AMOUNT ENCLOSED

$

Check here if this is a final return

Check here for address change, note changes on reverse side

(A)

(B)

(C)

(D)

(E)

Type of Tax/Tax Area

Gross Sales

Total Deductions

Net Taxable

Tax Rate

Gross Tax Due

(Column A - Column B)

(Column C x Column D)

Sales/Sellers Use

(General)

3%

Sales/Sellers Use

(Automotive)

1%

Consumers Use

(General)

3%

Consumers Use

(Automotive)

1%

Rental (General)

2%

½

Rental (Automotive)

%

(1) TOTAL TAX DUE

th

(Total of Column E)

This return must be postmarked by the 20

day of

the month following the reporting period for which

(2) PENALTY (

Failure to Timely File)

you are filing to be considered a timely return.

The greater of 10% or $50.00

(3) PENALTY (

Failure to Timely Pay)

10%

By signing this report I am certifying that this report,

including any accompanying schedules or statements,

(4) INTEREST

has been examined by me and is to the best of my

(Item 1 X 1% per month)

knowledge and belief a true and complete report for

the period stated.

(5) DISCOUNT –

ALLOWED ON SALES

AND SELLERS USE TAX ONLY

(If timely filed and paid)

5% on $100 or less, 2% on tax over $100

Date __________________ Title _____________________

(6) NET TAX DUE

(Item 1 – Item 5)

(If delinquent, Items 1+2+3+4)

Signature________________________________________

TOTAL AMOUNT DUE & ENCLOSED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2