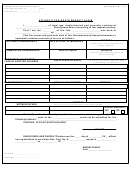

Death Benefit Claim Page 10

ADVERTISEMENT

that are subject to time delays upon withdrawal, the deposit to their financial institution may be delayed accordingly. In the event of a change to the periodic

payments, the electronic funds transfer may be subject to a delay, and a check will be sent to the Claimant’s last known address on file with Service Provider.

If the Claimant’s financial institution rejects the pre-notification, the Claimant will be notified and the checks will be mailed to the Claimant until the

Claimant submits an Electronic Funds Transfer (ACH) form. As a result, it is important that the Claimant continues to notify the Service Provider in

writing of any changes to their mailing address.

By choosing an ACH credit to Claimant’s bank account, the Claimant is authorizing the Service Provider to initiate credit entries and, if necessary, debit

entries and adjustments for any credit entries in error to the Claimant’s checking or savings account. The Claimant is also authorizing their financial

institution, in the form of an electronic funds transfer, to credit and/or debit the same to such account. The Service Provider will make payments in

accordance with the directions the Claimant has specified on the Form until such time that the Claimant notifies the Service Provider in writing that they

wish to cancel the ACH agreement. The Claimant must provide notice of cancellation at least 30 days prior to a payment date for the cancellation to be

effective with respect to all of their subsequent payments.

The Service Provider reserves the right to terminate the ACH transfers for any reason and will notify the Claimant in the event of such termination by

sending notice to their last known address on file with the Service Provider.

It is the Claimant’s obligation to notify the Service Provider of any address or other changes affecting their electronic fund transfers during their lifetime.

The Claimant is solely responsible for any consequences and/or liabilities that may arise out of their failure to provide such notification.

By selecting an ACH method of delivery, the Claimant acknowledges that the Service Provider is not liable for payments made by the Service Provider

in accordance with a properly completed Form. By selecting this method of distribution delivery, the Claimant is authorizing and directing their financial

institution not to hold any overpayments made by the Service Provider on their behalf, or on behalf of their estate or any current or future joint

accountholder, if applicable.

Federal and State Income Tax Withholding

Federal

— Direct rollovers are available for spousal Claimants only. No federal income tax will be withheld from direct rollovers. 20% mandatory federal

income tax withholding will apply to all distributions that are eligible for rollover, but are not rolled over.

For distributions not eligible for rollover, the distribution is subject to federal income tax withholding unless the Claimant elects not to have withholding

apply. If the Claimant elects not to have federal income tax withholding apply to his or her claim or if he or she does not have enough federal income tax

withheld from the claim, the Claimant may be responsible for payment of estimated tax. The Claimant may incur penalties under the estimated tax rules

if his or her withholding and estimated tax payments are not sufficient. Check the appropriate box on the Form.

For non-spousal Claimants, federal income tax will be withheld at the rate of lo%, unless the Service Provider is directed otherwise. Check the appropriate

box on the Form.

State

— For all Claimants, if the Claimant lives in a state that mandates state income tax withholding, it will be withheld. If the Claimant wishes to have

additional state income tax withheld or if the claimant lives in a state that does not mandate state income tax withholding, the Claimant may elect to have

an additional amount. Check the appropriate box on the Form.

Income Tax Withholding Applicable to Payments Delivered Outside the U.S.

If the Claimant is a U.S. citizen or a resident alien and the Claimant’s payment is to be delivered outside the U.S. or its possessions, you may not elect out

of federal income tax withholding.

If the Claimant is a non-resident alien, the Claimant must attach IRS Form W-8BEN. In general, the withholding rate applicable to the claim is 30% unless

a reduced rate applies because the Claimant’s country of citizenship has entered into a tax treaty with the U.S. and the treaty for a reduced withholding rate

or an exemption from withholding. To obtain IRS Form W-8BEN, call 1-800-TAX-FORM. Contact your tax professional for more information.

Required Signatures

The Claimant must sign the Form. Read the disclosure on the Form in this section before signing. Once they sign the Form, the Claimant attests to

receiving, reading, understanding and agreeing to all provisions of the Form, the Special Tax Notice and this Guide.

The authorized ING Representative’s signature is also required. The claim will not be processed without these signatures. Once the Claimant has completed

the Form, forward it to the address indicated on the last page of the Form under the Required Signatures section.

Important Note

Although every effort is made to keep the information in this Guide current, it is subject to change without notice. Federal, state, and local tax laws may

be revised, and new plan provisions may be adopted by your Plan. For the most up to date version of this Guide, please visit the Web site at

by selecting the Defined Contribution Plans tab, or call a Participant Service Representative at 1-VRS-DC-PLAN1 (1-877-327-5261).*

*Access to phone representatives or the Web site may be limited or unavailable during periods of peak demand, market volatility, systems upgrades,

maintenance or for other reasons.

ING_VRS_Death

Page 5 of 8 Guide

Benefit Claim_12.30.10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13