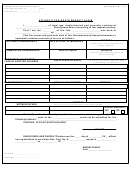

Death Benefit Claim Page 7

ADVERTISEMENT

Home Phone, Work Phone

— This information will allow the Service Provider to contact the Claimant if necessary regarding the claim.

Specify Claimant’s Relationship to the Decedent

— The Claimant’s relationship to the decedent is required in order to properly process the claim.

Is Claimant a U.S. Citizen?

— Federal and state income tax reporting is based on citizenship status.

Date of Birth

— The Claimant’s date of birth is required to properly process the claim.

Is Claimant a Minor?

— If the answer to this question is yes, complete the next section on the Form regarding the minor’s representative information.

Minor’s Representative Information

— This section must be completed if the Claimant is a minor. All correspondence and claims will be

addressed to the minor’s representative for the benefit of the Claimant.

Tax Identification Number

— Provide a complete and correct tax identification number for the Claimant on the Form. If the Claimant is an individual,

provide the individual’s social security number. If the Claimant is a trust or estate, generally a tax identification number (TIN) must be provided. In cases

of a trust Claimant, a social security number may be appropriate if the grantor is living and is also the trustee.

Type of Claim

1

If the decedent died before reaching the required beginning date (the later of age 70

/

or retirement) and is a(n):

2

Individual Claimant

— If the Claimant is an individual, such as the Participant’s spouse or child, minimum required distributions for years after the

year of the Participant’s death are generally based on a distribution period that can be determined using the Beneficiary’s single life expectancy. This rule

applies whether or not the death occurred before the Participant’s required beginning date.

1

If the surviving spouse is the sole Claimant, and the Participant died before the year in which he or she attained age 70

/

, or such other date as may be

2

1

prescribed in the Code, distributions to the spouse need not begin until the year in which the Participant would have attained age 70

/

, or such other date

2

as prescribed in the Code.

If the Claimant is an individual other than the spouse, the distribution period is based on the Claimant’s age (as of his or her birthday in the year following

the year of the participant’s death), reduced by one for each elapsed year since the year following the Participant’s death. Distributions must commence

by December 31 of the year following the year of the Participant’s death.

An individual Claimant may also elect the 5-year rule described below.

Non-Individual Claimant

— If the Participant died on or after the required beginning date and the Claimant is not an individual, required minimum

distributions are based upon the Participant’s age (as of his or her birthday in the year of death), reduced by one for each elapsed year since the year of death.

If the Participant died before the required beginning date, the entire account must be distributed by the end of the fifth year following the year of the

Participant’s death. A distribution is not required to be made before the fifth year following the Participant’s death.

Minor Claimant

— Payments may be made to a guardian of a minor’s estate or a conservator who has been appointed as such for the minor by final judicial

order. A copy of the court order must be submitted to the Plan Administrator/Trustee and forwarded to the Service Provider with the completed Form.

Under the Uniform Transfers to Minors Act, if a guardian or conservator has not been appointed by an appropriate court, certain states allow funds to be

transferred to a custodian for the minor who is an adult member of the minor’s family. In general, transfers under this law may not be made if a state has

not adopted it, or the proceeds exceed a specified dollar amount under the state’s statutory law. Payments cannot be made to a person solely because

he/she is the parent of the minor or has custody of the minor unless a state law in the minor’s state of residence specifically authorizes such payment, a

proper court order authorizing payment has been obtained or the Plan Document allows for such payment. The following is a list of states that have

adopted a version of the Uniform Transfers to Minors Act:

Alabama

Illinois

Montana

Rhode Island

Alaska

Indiana

Nebraska

South Dakota

Arizona

Iowa

Nevada

Tennessee

Arkansas

Kansas

New Hampshire

Texas

California

Kentucky

New Jersey

U.S. Virgin Islands

Colorado

Louisiana

New Mexico

Utah

Connecticut

Maine

New York

Virginia

Delaware

Maryland

North Carolina

Washington

District of Columbia

Massachusetts

North Dakota

West Virginia

Florida

Michigan

Ohio

Wisconsin

Georgia

Minnesota

Oklahoma

Wyoming

Hawaii

Mississippi

Oregon

Idaho

Missouri

Pennsylvania

It is the Claimant’s responsibility to determine whether and to what extent the Uniform Transfers to Minors Act has been adopted in his or her state of

residence.

If the Service Provider is unable to make payment because a guardian or conservator has not been appointed by final judicial order, or a state law where

the minor resides, the proceeds must remain in the decedent’s account until the minor reaches the age of majority.

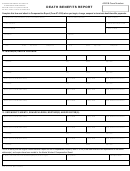

ING_VRS_Death

Page 2 of 8 Guide

Benefit Claim_12.30.10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13