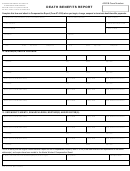

Death Benefit Claim Page 6

ADVERTISEMENT

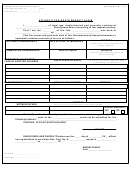

DEATH BENEFIT CLAIM GUIDE

Commonwealth of Virginia Defined Contribution Plans — Governmental 457(b) Plan

This Guide will assist you in completing the Death Benefit Claim Request form (the “Form”) for Internal Revenue Code (“Code”) section Governmental

457(b) plan. You should read all pages of this Guide before you begin to complete the Form. The Guide will assist you in completing each section of the

Form and give you the information you need to make informed decisions regarding your claim. If you need further clarification about the information

discussed in this Guide, call a Participant Services Representative at 1-VRS-DC-PLAN1 (1-877-327-5261).

You are strongly urged to consult with an accountant and/or tax advisor in the preparation of the Form. While our representatives are able to explain your

options to you, they cannot tell you which payment and tax-withholding method is best for you. Your local representative or any Participant Services

Representative will not provide tax or legal advice. Additionally, neither this Guide nor the Form provides tax or legal advice relevant to your claim.

Please note that ING (the Service Provider) cannot release the claim until the Authorized Plan Administrator/Trustee confirms that you are a named

beneficiary under the Plan and are otherwise entitled to assert a claim.

Waivers or Consents of Inheritance and Estate Taxes

— Certain states require the Service Provider to obtain waivers or consents from the state’s

Department of Revenue or Taxation before the Claimant is able to assert a claim. If the decedent lived in a state that requires this waiver, you MUST

attach the waiver to the Form at the time the Form is submitted to the Service Provider. The states that currently require consent or waiver are as follows:

Connecticut, Hawaii, Indiana, Kentucky, Mississippi, Montana, Nebraska, New Hampshire, New Jersey, New York, Oklahoma, Oregon, Puerto Rico,

Rhode Island, Tennessee, Wisconsin. If the decedent’s state of residence does not appear in this list, it is the Claimant’s responsibility to ensure that the

decedent’s state of residence does not require any form of waiver or consent.

Additionally, certain states require that the Service Provider provide notice to the state that a distribution will be made to a claimant. If the decedent’s

state of residence requires a notice of distribution, the Service Provider will so notify the appropriate state department.

The Form

— The Form is divided into several sections, with each section requiring you to provide specific information.

The sections on the Form are:

Decedent’s Information

Tax Identification Number

Claim Delivery

I

I

I

Claimant’s Information

Type of Claim

Federal and State Income Tax Withholding

I

I

I

Minor’s Representative Information

Direct Rollover

Required Signatures

I

I

I

Note: If there is more than one account or plan number, you must complete a separate Form for each account or plan number.

Incomplete or Inaccurate Information

— In the event that any section of the Form is incomplete or inaccurate, the Service Provider may not be able

to process the claim requested on the Form. You may be required to complete a new Form or provide additional or proper information before your claim

will be processed.

Changes to Your Request

— If you make a change to the Form as you are completing it, you must cross out any previously elected choice(s) and initial

all changes. If you do not initial all changes, the Form may be returned to you for verification.

Self-Directed Brokerage (“SDB”) Account Notice

— If the decedent had a SDB account, the Service Provider will contact the self-directed brokerage

provider to transfer the funds to the core investments (non-self-directed brokerage investments) before the Service Provider can process the claim. These

monies will be invested in the plan default fund.

The Form

Note: Please use black or blue ink when completing the Form.

Decedent’s Information

Last Name, First Name, MI

— The decedent’s full name is required in order to properly identify the account.

City, State, and Country of Legal Domicile at time of death

— This information is required in order for the claim to be properly filed

and tax reported.

Was Decedent a U.S. Citizen?

— Federal and state income tax reporting is based on citizenship status.

Social Security Number

— The decedent’s Social Security Number is required to properly identify the account and report any applicable

withholding information to the Internal Revenue Service.

Date of Birth

— The decedent’s date of birth is required to properly process the claim.

Date of Death

— The decedent’s date of death is required to properly process the claim.

Claimant’s Information: Last Name, First Name, MI

— The full name of the Claimant is required in order to properly process the claim.

Address: Number & Street, City, State, Zip Code

— This information is required in order to properly process the claim.

ING_VRS_Death

Page 1 of 8 Guide

Benefit Claim_12.30.10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13