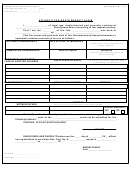

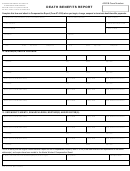

Death Benefit Claim Page 11

ADVERTISEMENT

Your Rollover Options for Payments Not from a Designated Roth Account

You are not required to take a distribution from your plan when you leave employment, other than the minimum amount required when you reach age

70 ½. If you decide to take a distribution of some or all of your plan account balance, you have payout choices including a rollover to another plan or IRA.

You are receiving this notice because all or a portion of a payment you are receiving from the Commonwealth of Virginia Deferred Compensation Plan

(the Plan ) is eligible to be rolled over to an IRA or an employer plan. This notice is intended to help you decide whether to do such a rollover.

Rules that apply to most payments from a plan are described in the General Information About Rollovers section. Special rules that only apply in certain

circumstances are described in the Special Rules and Options section.

GENERAL INFORMATION ABOUT ROLLOVERS

How can a rollover affect my taxes?

You will be taxed on a payment from the plan paid directly to you. You may delay the payment of taxes by rolling over to another plan or IRA. You will

be required to start a minimum distribution when you reach age 70 ½. Payments directly to you prior to age 59 ½ may result in an additional 10% early

withdrawal penalty. This penalty does apply to money you roll over or receive after youreach age 59 ½. The early withdrawal penalty does not apply to

distributions from a 457(b) governmental deferred compensation plan.

If I don t roll over a plan distribution, will I have to pay the 10% additional income tax on early distributions?

If you are under age 59½, you will have to pay the 10% additional income tax on early distributions for any payment from the Plan (including amounts

withheld for income tax) paid directly to you, unless one of the exceptions listed below applies. This tax is in addition to the regular income tax on the

payment not rolled over.

The 10% additional income tax does not apply to the following payments from the Plan:

Payments from a government 457(b) plan

I

Payments made after you separate from service if you will be at least age 55 in the year of the separation

I

Payments that start after you separate from service if paid at least annually in equal or close to equal amounts over your life or

I

life expectancy (or the lives or joint life expectancy of you and your beneficiary)

Payments made due to disability

I

Payments after your death

I

Corrective distributions of contributions that exceed tax law limitations

I

Contributions made under special automatic enrollment rules that are withdrawn pursuant to your request within 90 days of

I

your first contribution

Payments made directly to the government to satisfy a federal tax levy

I

Payments made under an approved domestic relations order (ADRO)

I

Payments up to the amount of your deductible medical expenses

I

Certain payments made while you are on active duty if you were a member of a reserve component called to duty after September 11, 2001

I

for more than 179 days.

Payments from a governmental defined benefit pension plan made after you separate from service if you are a public safety employee

I

(as defined by the IRS) and you are at least age 50 in the year of the separation

Where may I roll over the payment?

You may roll over the payment to either a traditional IRA (an individual retirement account or individual retirement annuity) or an employer plan (a

tax-qualified plan, section 403(b) plan, or governmental section 457(b) plan) that will accept the rollover. The rules of the IRA or employer plan that

will receive the rollover will determine your investment options, fees, and rights to payment from the IRA or employer plan (for example, no spousal

consent rules apply to IRAs and IRAs may not provide loans). Further, the amount rolled over will become subject to the tax rules that apply to the

IRA or employer plan. You may not roll over to a Roth IRA.

How do I do a rollover?

There are two ways to do a rollover. You can do either a direct rollover or a 60-day rollover.

If you do a direct rollover, the Plan will make the payment directly to your IRA or an employer plan. You should contact the IRA sponsor or the

administrator of the employer plan for information on how to do a direct rollover.

If you do not do a direct rollover, you may still do a rollover by making a deposit into an IRA or eligible employer plan that will accept it. You will

have 60 days after you receive the payment to make the deposit. If you do not do a direct rollover, the Plan is required to withhold 20% of the payment

for federal income. This means that, in order to roll over the entire payment in a 60-day rollover, you must use other funds to make up for the 20%

withheld. If you do not roll over the entire amount of the payment, the portion not rolled over will be taxed and will be subject to the 10% additional

income tax on early distributions if you are under age 59½ (unless an exception applies).

ING_VRS_Death

Page 6 of 8 Guide

Benefit Claim_12.30.10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13