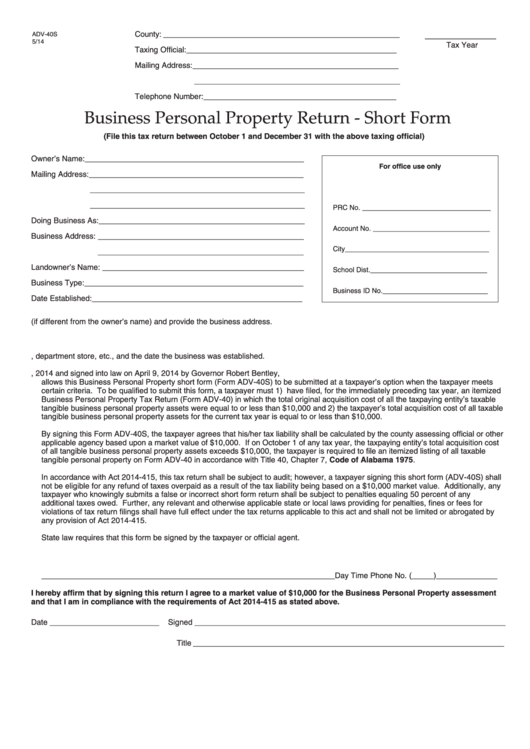

County: ______________________________________________________

ADV-40S

_______________

5/14

Tax Year

Taxing Official: ________________________________________________

Mailing Address: _______________________________________________

_______________________________________________

Telephone Number: ____________________________________________

Business Personal Property Return - Short Form

(File this tax return between October 1 and December 31 with the above taxing official)

Owner’s Name: __________________________________________________

For office use only

Mailing Address: _________________________________________________

_________________________________________________

_________________________________________________

PRC No. _________________________________

Doing Business As: _______________________________________________

Account No. ______________________________

Business Address: _______________________________________________

City_____________________________________

_______________________________________________

Landowner’s Name: ______________________________________________

School Dist. ______________________________

Business Type: __________________________________________________

Business ID No. ___________________________

Date Established: ________________________________________________

1. Complete the spaces provided above for doing business as (if different from the owner’s name) and provide the business address.

2. Provide the name of the landowner.

3. Also provide the business type such as restaurant, department store, etc., and the date the business was established.

4. Act 2014-415 passed by the Alabama Legislature on April 3, 2014 and signed into law on April 9, 2014 by Governor Robert Bentley,

allows this Business Personal Property short form (Form ADV-40S) to be submitted at a taxpayer’s option when the taxpayer meets

certain criteria. To be qualified to submit this form, a taxpayer must 1) have filed, for the immediately preceding tax year, an itemized

Business Personal Property Tax Return (Form ADV-40) in which the total original acquisition cost of all the taxpaying entity’s taxable

tangible business personal property assets were equal to or less than $10,000 and 2) the taxpayer’s total acquisition cost of all taxable

tangible business personal property assets for the current tax year is equal to or less than $10,000.

By signing this Form ADV-40S, the taxpayer agrees that his/her tax liability shall be calculated by the county assessing official or other

applicable agency based upon a market value of $10,000. If on October 1 of any tax year, the taxpaying entity’s total acquisition cost

of all tangible business personal property assets exceeds $10,000, the taxpayer is required to file an itemized listing of all taxable

tangible personal property on Form ADV-40 in accordance with Title 40, Chapter 7, Code of Alabama 1975.

In accordance with Act 2014-415, this tax return shall be subject to audit; however, a taxpayer signing this short form (ADV-40S) shall

not be eligible for any refund of taxes overpaid as a result of the tax liability being based on a $10,000 market value. Additionally, any

taxpayer who knowingly submits a false or incorrect short form return shall be subject to penalties equaling 50 percent of any

additional taxes owed. Further, any relevant and otherwise applicable state or local laws providing for penalties, fines or fees for

violations of tax return filings shall have full effect under the tax returns applicable to this act and shall not be limited or abrogated by

any provision of Act 2014-415.

State law requires that this form be signed by the taxpayer or official agent.

5. Person to contact if additional information is required.

___________________________________________________________________ Day Time Phone No. (_____)______________

I hereby affirm that by signing this return I agree to a market value of $10,000 for the Business Personal Property assessment

and that I am in compliance with the requirements of Act 2014-415 as stated above.

Date _________________________

Signed _______________________________________________________________________

Title _______________________________________________________________________

1

1