Income Withholding For Support

Download a blank fillable Income Withholding For Support in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Income Withholding For Support with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

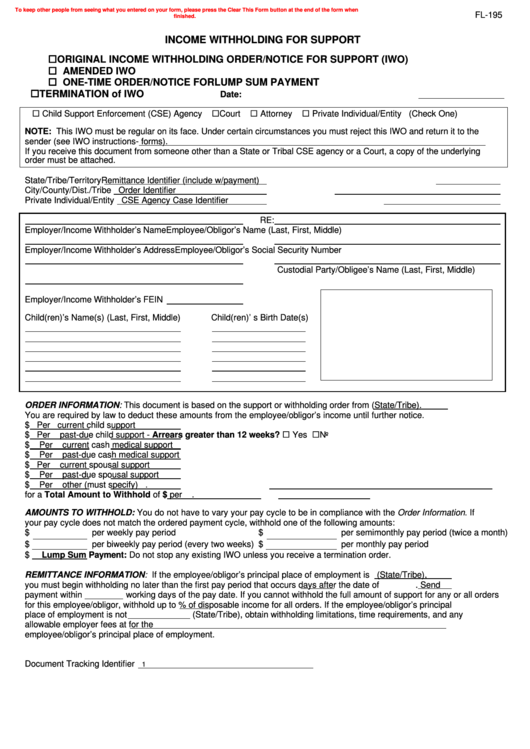

To keep other people from seeing what you entered on your form, please press the Clear This Form button at the end of the form when

FL-195

finished.

INCOME WITHHOLDING FOR SUPPORT

ORIGINAL INCOME WITHHOLDING ORDER/NOTICE FOR SUPPORT (IWO)

AMENDED IWO

ONE-TIME ORDER/NOTICE FOR LUMP SUM PAYMENT

TERMINATION of IWO

Date:

Child Support Enforcement (CSE) Agency

Court

Attorney

Private Individual/Entity (Check One)

NOTE: This IWO must be regular on its face. Under certain circumstances you must reject this IWO and return it to the

sender (see IWO instructions - forms).

If you receive this document from someone other than a State or Tribal CSE agency or a Court, a copy of the underlying

order must be attached.

State/Tribe/Territory

Remittance Identifier (include w/payment)

City/County/Dist./Tribe

Order Identifier

Private Individual/Entity

CSE Agency Case Identifier

RE:

Employer/Income Withholder’s Name

Employee/Obligor’s Name (Last, First, Middle)

Employer/Income Withholder’s Address

Employee/Obligor’s Social Security Number

Custodial Party/Obligee’s Name (Last, First, Middle)

Employer/Income Withholder’s FEIN

Child(ren)’s Name(s) (Last, First, Middle)

Child(ren)’ s Birth Date(s)

ORDER INFORMATION: This document is based on the support or withholding order from

(State/Tribe).

You are required by law to deduct these amounts from the employee/obligor’s income until further notice.

$

Per

current child support

past-due child support - Arrears greater than 12 weeks? Yes No

$

Per

$

Per

current cash medical support

$

Per

past-due cash medical support

$

Per

current spousal support

$

Per

past-due spousal support

$

Per

other (must specify)

.

for a Total Amount to Withhold of $

per

.

AMOUNTS TO WITHHOLD: You do not have to vary your pay cycle to be in compliance with the Order Information. If

your pay cycle does not match the ordered payment cycle, withhold one of the following amounts:

$

per weekly pay period

$

per semimonthly pay period (twice a month)

$

per biweekly pay period (every two weeks) $

per monthly pay period

$

Lump Sum Payment: Do not stop any existing IWO unless you receive a termination order.

REMITTANCE INFORMATION: If the employee/obligor’s principal place of employment is

(State/Tribe),

you must begin withholding no later than the first pay period that occurs

days after the date of

. Send

payment within

working days of the pay date. If you cannot withhold the full amount of support for any or all orders

for this employee/obligor, withhold up to

% of disposable income for all orders. If the employee/obligor’s principal

place of employment is not

(State/Tribe), obtain withholding limitations, time requirements, and any

allowable employer fees at for the

employee/obligor’s principal place of employment.

Document Tracking Identifier

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3