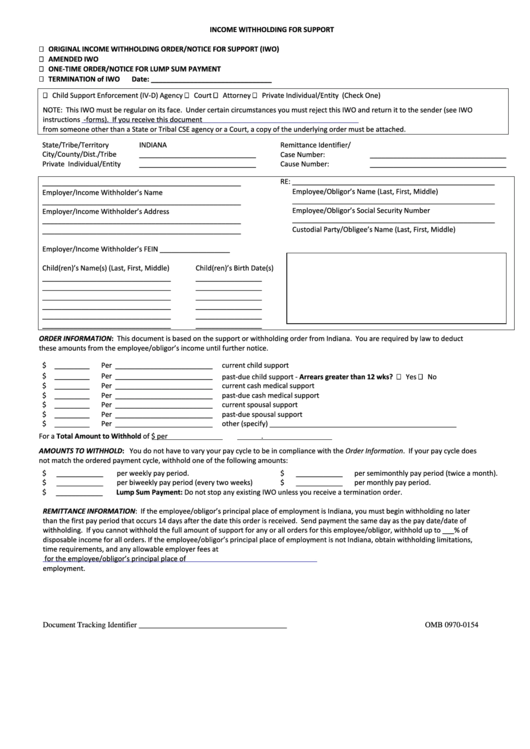

INCOME WITHHOLDING FOR SUPPORT

ORIGINAL INCOME WITHHOLDING ORDER/NOTICE FOR SUPPORT (IWO)

AMENDED IWO

ONE-TIME ORDER/NOTICE FOR LUMP SUM PAYMENT

TERMINATION of IWO

Date: _______________________________

Child Support Enforcement (IV-D) Agency

Court

Attorney

Private Individual/Entity

(Check One)

NOTE: This IWO must be regular on its face. Under certain circumstances you must reject this IWO and return it to the sender (see IWO

instructions

-forms). If you receive this document

from someone other than a State or Tribal CSE agency or a Court, a copy of the underlying order must be attached.

State/Tribe/Territory

INDIANA

Remittance Identifier/

City/County/Dist./Tribe

______________________________

Case Number:

___________________________________

Private Individual/Entity

______________________________

Cause Number:

___________________________________

RE: ____________________________________________________

___________________________________________________

Employee/Obligor’s Name (Last, First, Middle)

Employer/Income Withholder’s Name

____________________________________________________

___________________________________________________

Employee/Obligor’s Social Security Number

Employer/Income Withholder’s Address

____________________________________________________

___________________________________________________

Custodial Party/Obligee’s Name (Last, First, Middle)

___________________________________________________

Employer/Income Withholder’s FEIN __________________

Child(ren)’s Name(s) (Last, First, Middle)

Child(ren)’s Birth Date(s)

_________________________________

_________________

_________________________________

_________________

_________________________________

_________________

_________________________________

_________________

_________________________________

_________________

_________________________________

_________________

ORDER INFORMATION: This document is based on the support or withholding order from Indiana. You are required by law to deduct

these amounts from the employee/obligor’s income until further notice.

$ _________

Per _________________________

current child support

$ _________

Per _________________________

past-due child support - Arrears greater than 12 wks?

Yes

No

$ _________

Per _________________________

current cash medical support

$ _________

Per _________________________

past-due cash medical support

$ _________

Per _________________________

current spousal support

$ _________

Per _________________________

past-due spousal support

$ _________

Per _________________________

other (specify) ________________________________________________

For a Total Amount to Withhold of $

per

.

AMOUNTS TO WITHHOLD: You do not have to vary your pay cycle to be in compliance with the Order Information. If your pay cycle does

not match the ordered payment cycle, withhold one of the following amounts:

$

____________

per weekly pay period.

$

____________

per semimonthly pay period (twice a month).

$

____________

per biweekly pay period (every two weeks)

$

____________

per monthly pay period.

ONE ____________

$

Lump Sum Payment: Do not stop any existing IWO unless you receive a termination order.

REMITTANCE INFORMATION: If the employee/obligor’s principal place of employment is Indiana, you must begin withholding no later

than the first pay period that occurs 14 days after the date this order is received. Send payment the same day as the pay date/date of

withholding. If you cannot withhold the full amount of support for any or all orders for this employee/obligor, withhold up to ___% of

disposable income for all orders. If the employee/obligor’s principal place of employment is not Indiana, obtain withholding limitations,

time requirements, and any allowable employer fees at

for the employee/obligor’s principal place of

employment.

Document Tracking Identifier ______________________________________

OMB 0970-0154

1

1 2

2 3

3