Balance Sheets, Income Statements And Statements Of Cash Flow Page 3

ADVERTISEMENT

Feature

The State of Statements

ages, it is said to depreciate. This deprecia-

tion of the equipment is an expense and

can be claimed as a tax deduction. The

accountant for the practice will evaluate the

appropriate method for calculation and the

extent of deductions available for every fixed

asset listed on the balance sheet.

Liabilities include all obligations the prac-

tice has acquired through daily operations of

the practice. Liabilities include Accounts

Payable (ex. hearing instrument acquisition

costs), Accrued Business Expenses, Interest

Owed on Loans, and other obligations

incurred from daily operations. Owner’s or

shareholder’s equity includes financial invest-

ment by the owner or shareholders and the

earned profits that are retained in the busi-

ness. Current liabilities are listed as amounts

owed to lenders and suppliers and are usu-

ally separated by those that are due in the

short term and long term. As with the asset

categories, current liabilities are delineated

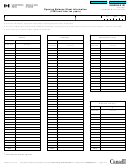

Table 1: Balance Sheet (Traynor, 2008)

into subcategories such as short term debt,

accounts payable and accrued liabilities.

must numerically balance, as presented in

agent to convert cash into cash. Accounts

These are referred to as current liabilities

the classic formula presented below:

Receivable is listed second since it represents

since they are due to be paid in a short peri-

Cash but must be ìconvertedî into cash by

od of time, usually within the fiscal year. A

Assets = (Liabilities + Owner’s

collection. Assets are commonly differenti-

separate category is retained for long term

Equity) + (Revenue – Expenses)

ated into two classes; Current Assets and

debt,such as bank or other loans payable over

Fixed or Long-term Assets, see Table 1.

a much longer period, usually longer than

Assets are recorded on left side of the

Current Assets are short-lived and expected

the fiscal year. All current and long term lia-

Balance Sheet and Liabilities and Owner’s

to be converted into cash or to be expend-

bility amounts are then totaled collectively

(stockholders) Equity are recorded on the

ed in the operations of the practice within

to reflect the total liability of the practice (see

right side of the Balance Sheet, as presented

a short period of time, usually within a fis-

Table 1). Owner’s (shareholder) Equity rep-

in Table 1. Total Assets are set to equal 100

cal year. Current Assets include cash,

resents funds that were initially invested by

percent, with all other assets listed as a per-

accounts receivable,product inventory (hear-

the owner as well as the profit that was

centage of the total assets. On the right side

ing instrument and assistive listening device

earned and retained in the practice.

of the Balance Sheet, Total Liabilities and

inventory,batteries,etc) and prepaid expens-

Equity are also set equal to 100 percent.

es, such as insurance.

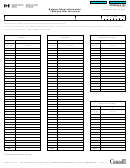

Income Statement

Entries of all liabilities and owner’s (stock-

Next are the Long-term or Fixed Assets

The Income Statement is sometimes

holders) equity accounts are also represent-

that will not be turned into cash within the

called a profit and loss statement or “P and

ed as the appropriate percent of the total

practice’s fiscal year. Examples of Long-

L”statements and depicts the status of over-

liabilities and equity. The Balance Sheet

term or Fixed Assets may include,but are not

all profit within the business. McNamara

must contain all of the practice’s financial

limited to, audiometric and other equip-

(2007) indicates that income statements

accounts and should be generated at least

ment used in the practice, office equipment

simply include how much money has been

once a month. Monthly review of the bal-

and computers, purchased vehicles, pur-

earned (revenue), subtracts how much

ance sheet provides a timely,comprehensive

chased buildings, leasehold or tenant

money has been spent (expenses) that

overview of the practice’s overall financial

improvements, telephone systems. These

results in how much money has been made

position at that specific point in time.

assets are found in the balance sheet (Table

(profits) or lost (deficits).Basically,the state-

Assets listed on the Balance Sheet are items

1) listed as ìProperty, Plant and Equipmentî

ment includes total sales minus total

of value that represent the financial resources

or as ìFixed Assetsî. To best conceptualize

expenses.It presents the nature of the prac-

of the practice. Accounts listed on the

Long-term or Fixed Assets, consider that

tice’s overall profit and loss over a specified

Balance Sheet are placed in order of their rel-

most fixed assets are purchased over time and

period of time. Therefore, the Income

ative degree of liquidity (ease of convert-

must be in place over a long period of time

Statement gives a practitioner a sense for

ibility to cash),therefore,Cash is always listed

to foster the day-to-day clinical and business

first since it does not require an action or an

operations of the practice. As equipment

Continued On Next Page

9

F

• V

19, N

3 • F

2008

EEDBACK

OLUME

UMBER

ALL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5