Balance Sheets, Income Statements And Statements Of Cash Flow Page 4

ADVERTISEMENT

Feature

The State of Statements

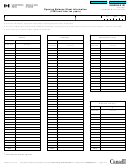

er, does not include any operating, interest,

or income tax expenses. Just below the Net

Profit entry in Table 2 is a category for

Selling and General Administrative

Expenses. This subcategory is described by

Tracy (2001) and Marshall (2004) as a broad

ìcatch-allî category for all expenses except

those reported elsewhere in the Income

Statement. Examples of selling and gener-

al administrative expenses that are recorded

here are legal expenses, the owner’s salary,

advertising, travel and entertainment, and

other similar costs.The actual income from

operations, sometimes called Earnings

Before Interest and Taxes (EBIT) is the result

of deducting the Selling and General

Administrative Expenses from the Net

Profit. The earnings Before Interest and

Taxes (EBIT) are the net revenue generat-

ed by the practice. Interest expenses and

taxes are subtracted to arrive at the Net

Income (or Loss).

Table 2: Income Statement (Traynor, 2008)

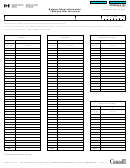

Statements of Cash Flow

how efficiently the business is operating.

tices’ income tax liability. Since it is very

Statements of Cash Flow reflect the cash

In accounting, the practice’s profitability

important to format an Income Statement

position of the practice as well as the

is measured by comparing the revenues gen-

appropriate to the type of business being

sources and uses of cash in the practice

erated in a given period with the expenses

conducted, the structure of income state-

during a specified business cycle. It pres-

incurred to produce those revenues. The

ments may vary from one practice to anoth-

ents how cash flows in and out of the prac-

difference between the revenue generated

er. In audiology the format may depend

tice. Monthly cash flow statements are

and the expenses created during the gener-

upon the mix of business conducted in diag-

useful but quarterly statements of cash flow

ation of the revenue is the profit (or loss) of

nostics, hearing products, and rehabilitative

are essential to provide a look at trends

the practice. In an Audiology practice, rev-

services.

that might be developing in the overall

enues are defined as the inflow of revenue

Net sales on the Income Statement con-

cash-flow picture of the business. Profit and

from providing patient care or the dispens-

sist of sales figures representing the actual

cash-flow are intimately related. A practice

ing of products.Expenses can be considered

revenue generated by the business.Marshall

can be highly profitable yet on the verge of

the sacrifices made or the costs incurred to

(2004) states that the Net Sales entry on the

bankruptcy if the profits are sequestered,for

produce these revenues. If revenues exceed

Income Statement represents the total

example in the Accounts Receivable—high

expenses,net earnings result while if expens-

amount of all sales less product returns and

profit, low cash flow. This situation results in

es exceed net revenue, a loss is recorded.

sales discounts. Directly below the Net

limited cash to pay the practitioner,employ-

As with other financial statements, the

Sales in Table 2, is the Cost Of Goods Sold

ees and/or to service the accounts payable.

Income Statement, presented in table 2,

(COGS). COGS are costs directly associ-

Conversely,if there is substantial cash inflow

may be prepared for any financial reporting

ated with making and/or acquiring the

to a practice but excessive overhead costs that

period and is used to track revenues and

products.These costs include the acquisition

are strangling profitability, financial difficul-

expenses critically important in assessing

of products, such as hearing aids or assistive

ties will ensue—low profit,high cash flow. This

the operating performance of the practice.

devices provided by outside suppliers. If

is a situation where in the practice owner has

(2003b) suggests that

hearing instrument are repaired or manu-

overextended available resources with ill-

managers can use income statements to find

factured by the practice, COGS could also

conceived equipment purchases,exception-

areas of the practice that are over or under

be materials, parts, and internal expenses

al leasehold costs, or extraneous staff salaries

budget and identify specific areas of unex-

related to the manufacturing or repair

and other questionable business decisions.

pected expenditures. Additionally, the

process, such as faceplates, shells, micro-

To illustrate how cash flows in and out of the

Income Statement tracks the increase or

phones, receivers, and components.

practice, Marshall (2004) indicates that the

decrease in product returns; cost of goods

Net Profit, sometimes called gross profit,

Statements of Cash Flow are used to identi-

sold as a percentage of sales and presents

is derived by subtracting the cost of goods

fy the sources and uses of cash over time and

some indication of the extent of the prac-

sold from net sales. This net profit, howev-

Continued On Page 26

10

F

• V

19, N

3 • F

2008

EEDBACK

OLUME

UMBER

ALL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5