Utah Partnership Limited Liability Partnership Limited Liability Company Return Of Income Page 10

ADVERTISEMENT

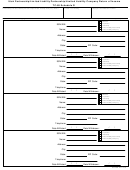

Instructions for TC-65 Schedule B

General Instructions

Amounts reportable for employment security purposes may

Use Schedule B to calculate the portion of the nonresident

partnership income attributable to Utah, if the partnership does

ordinarily be used to determine the wage factor.

business both within and outside of Utah.

Line 3(a) - Wages Fraction

Determine apportionment fraction by completing this schedule.

Column A, line 3 divided by column B, line 3. Overall wages,

including Utah, are listed in column B.

The factors express a percent for tangible property in Utah, for

wages and salaries in Utah, and for sales in Utah. Add these

Lines 4(a)-4(e) - Gross Receipts from Business

factors together and divide by the number of factors present

(typically 3) to arrive at the Utah apportionment fraction

The sales factor is the percentage the sales or charges for

services within the state for the taxable year bear to the overall

calculated to six decimals. Apply this fraction to the net

income (or loss) to arrive at the amount of income (or loss)

sales for the taxable year. Gross receipts from the performance

of services are in this state to the extent the services are

apportioned to Utah. In cases where one or more of the factors

are omitted due to peculiar aspects of the business operations,

performed in this state.

divide by the number of factors present.

Sales of tangible personal property are in this state if the

Briefly describe the nature and location(s) of your Utah

property is delivered or shipped to a purchaser within this state

regardless of the F.O.B. point or other conditions of the sale, or

business activities in the space provided at the top of this

schedule.

if the property is shipped from an office, store, warehouse,

factory, or other place of storage in this state and (1) the

Lines 1(a)-1(e) - Tangible Property

purchaser is the United States government, or (2) the

Show the average cost value during the taxable year of real

partnership/LLP/LLC is not taxable in the state of the

and tangible personal property used in the business within the

purchaser.

state (including leased property) in column A; and overall

Nexus: The jurisdictional link that must be present before a

(including Utah) in column B.

state may tax a partnership upon its activities within a state's

borders.

Property owned by the parnership/LLP/LLC is valued at its

original cost. Property rented by the partnership/LLP/LLC is

Line 5 - Total Sales and Service

valued at eight times the net annual rental rate. Net annual

rental rate is the annual rental rate paid by the

Enter totals of lines 4(a)-4(e) in their respective columns.

partnership/LLP/LLC less the annual rental rate received by the

Line 5(a) - Sales Fraction

partnership/LLP/LLC from subrentals.

Determine sales fraction: column A, line 5 divided by column B,

line 5. Overall sales, including Utah, are listed in column B.

The average value of property must be determined by

averaging the cost values at the beginning and ending of the

Line 6 - Total Fraction

tax period. However, monthly values may be used or required if

monthly averaging more clearly reflects the average value of

Enter total of lines 2(a), 3(a), and 5(a).

the partnership/LLP/LLC's property.

Line 7 - Apportionment Fraction

A supporting schedule should be attached whenever monthly

Calculate the apportionment fraction to six decimals: Line 6

divided by the number of factors used (typically 3 - property,

averaging is used.

wages, and sales). If one or more of the factors are not present

(i.e., there is a zero represented on lines 2, 3, or 5 in column B),

Line 2 - Total Tangible Property

Enter totals of lines 1(a)-1(e) in the respective columns.

divide by the number of factors present. Enter apportionment

fraction here and on Schedule A, line 19.

Line 2(a) - Property Fraction

Determine property fraction: column A, line 2 divided by column

Specialized Apportionment Rules

Specialized apportionment rules apply for:

B, line 2.

* Trucking Companies (R865-6F-19)

* Railroads (R865-6F-29)

Line 3 - Wages, Salaries, Commissions, and Other

Includable Compensation

* Publishing Companies (R865-6F-31)

* Financial Institutions (R865-6F-32)

Wages, salaries, commissions, and other includable

compensation paid to employees for personal services must be

* Telecommunication (R865-6F-33)

included in the Utah factor to the extent that the services, for

which the compensation was paid, were rendered in Utah.

Compensation is paid in the state if:

(1) the individual's service is performed entirely within the state;

(2) the individual's service is performed both within and outside

the state, but the service performed outside the state is

incidental to the individual's service within the state; or

(3) some of the service is performed in the state and

(a) the base of operations or, if there is no base of operation,

the place from where the service is directed or controlled

within the state, or

(b) the base of operations or the place where the service is

directed or controlled is not in any state where some part

of the service is performed, but the individual's residence

is in this state.

65b-i.frm Rev. 12/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10