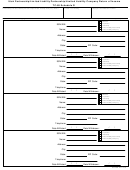

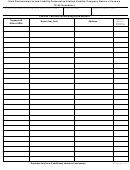

Utah Partnership Limited Liability Partnership Limited Liability Company Return Of Income Page 7

ADVERTISEMENT

TC-65 Instructions

1. Returns by Partnership/Limited Liability Partnership

may request form TC-15, Applicable Interest Rates, by calling

(LLP)/Limited Liability Company (LLC).

or writing the Utah State Tax Commission, 210 N 1950 W, SLC,

Every partnership/LLP/LLC having a resident partner/member,

UT 84134, telephone number (801) 297-6700 or

or having any income derived from sources in Utah, must file a

1-800-662-4330 ext. 6700.

return on form TC-65 for the taxable year, and must attach to

the return a copy of its federal partnership return, form 1065, for

The interest rate for most taxes and fees administered by the

the same year (without Schedules K-1) and a schedule of

Tax Commission for the 2001 calendar year is 8 percent.

modifications, if any, as required by instruction 13. In addition, a

7. Signature.

complete federal Schedule K-1 must be attached for each

In the case of a partnership/LLP, the return must be signed by

nonresident partner/member whose Utah reportable income is

any one of the general partners. In the case of an LLC, the

over $1,000. Do not send Schedules K-1 for Utah resident

return must be signed by any one of the members or, if the LLC

partners/ members.

has vested management in a manager or managers, the return

2. When and where the return must be filed.

must be signed by one of these managers. If receivers,

A return must be filed with the Utah State Tax Commission, 210

trustees in bankruptcy, or assignees are operating the property

N 1950 W, SLC, UT 84134-0270 on or before the 15th day of

or business of the partnership/LLP/LLC, then the receiver,

the fourth month following the close of the fiscal year or by April

trustee, or assignee must sign the return.

15th for a calendar year business. If the due date falls on a

8. Partnership/LLP/LLC not subject to tax.

Saturday, Sunday, or legal holiday, the return will be due the

following business day.

A partnership/LLP/LLC is not subject to Utah income tax.

Partners/members conducting business are liable for Utah

3. Extension of time for filing return.

income tax in their separate or individual capacities. However,

Taxpayers are automatically allowed an extension of up to six

see Instruction 14.

months to file their returns. This is an extension of time for filing

the return and not an extension of time to pay tax due. To avoid

9. Federal taxable income.

penalty and interest, the payment requirements must be met on

Utah law defines federal taxable income as "taxable income as

or before the original due date and all returns must be filed

currently defined in Section 63, Internal Revenue Code, 1986."

wihtin the six-month extension period.

Since the Utah state taxable income is based on the federal

taxable income, a partner's ability to carryforward and

The prepayment must equal at least 90 percent of the tax due

carryback partnership losses is determined on a federal level.

in the current year, or 100 percent of the amount of the

The loss taken by a partner in a given year must match the loss

previous year's Utah tax liability.

taken on the federal return. Losses cannot be independently

Underpayment of extension prepayment is subject to penalty

carriedback and carriedforward in any given year on the

(see below).

partner's state return.

4. Schedules for partner/member information.

10. Character of partnership/LLP/LLC items.

General partners'/members' information from Tax Commission

(a) Each item of partnership/LLP/LLC income, gain, loss, or

records is printed on form TC-65 Schedule G; limited

deduction has the same character for a partner/member as it

partners'/nonmanaging members' information is printed on form

has for federal income tax purposes. When an item is not

TC-65 Schedule L. Please make any necessary corrections or

characterized for federal income tax purposes, it has the same

additions to this information.

character for a partner/member as if realized directly from the

source realized by the partnership/LLP/LLC, or incurred in the

5. Penalties.

same manner as incurred by the partnership/LLP/LLC.

The penalty for failure to file a tax due return by the due date

(b) Where a partner's/member's distributive share of an item

is the greater of $20 or 10 percent of the unpaid tax. In addition,

of partnership/LLP/LLC income, gain, loss, or deduction is

if a tax balance remains unpaid 90 days after the due date, a

determined for federal income tax purposes by a special

second penalty, the greater of $20 or 10 percent of the tax

provision in the partnership/LLP/LLC agreement with respect to

balance, will be added for failure to pay timely.

such item, and where the principal purpose of such provision is

The penalty for failure to pay tax due as reported on a timely

the avoidance or evasion of tax, the partner's/member's

filed return, or within 30 days of a notice of deficiency, is the

distributive share of such item and any modification with

greater of $20 or 10 percent of the tax due.

respect thereto shall be determined as if the

partnership/LLP/LLC agreement made no special provision

The penalty for underpayment of the extension prepayment

with respect to that item.

is 2 percent per month of the unpaid tax during the extension

(c) In determining state taxable income of a resident

period.

partner/member, any modification (such as U.S. government

The penalty for failure to file an information return or a

bond interest) that relates to an item of the partnership/LLP/

complete supporting schedule is $50 for each return or

LLC income, gain, loss, or deduction shall be made in

schedule to a maximum of $1,000.

accordance with the partner's/member's distributive share, for

For a list of additional penalties that may be imposed, please

federal income tax purposes, of the items to which the

refer to Utah Code Ann. Section 59-1-401.

modification relates. Where a partner's/member's share of any

such item is not required to be taken into account separately for

6. Interest.

federal income tax purposes, the partner's/member's

Interest is assessed at the rate prescribed by law from the

distributive share of such item shall be determined in

original due date until paid in full. The interest rate applicable

accordance with his distributive share, for federal income tax

for most taxes and fees administered by the Tax Commision is

purposes, of partnership/LLP/LLC income or loss generally.

2 percentage points above the federal short-term rate in effect

for the preceding fourth calendar quarter. The IRS publishes

this rate in September of each year. For information, taxpayers

65i1.frm Rev. 12/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10