Utah Partnership Limited Liability Partnership Limited Liability Company Return Of Income Page 8

ADVERTISEMENT

11. Nonresident or part-year resident share of

If the partnership/LLP/LLC is the recipient of proceeds in

partnership/LLP/LLC items.

connection with mineral properties located within Utah, the

(a) In determining the adjusted gross income of a

partnership/LLP/LLC should attach copy "B" of form TC-675R

nonresident partner/member of any partnership/LLP/LLC, there

to the partnership/LLP/LLC return. The amounts withheld are

shall be included only that part derived from or connected with

allocated to each partner/member in proportion to each

sources in this state of the partner's/member's distributive

partner's/member's share of income and should be shown on

share of items of partnership/LLP/LLC income, gain, loss, or

the federal Schedule K-1, form 1065.

deduction entering into the partner's/member's federal adjusted

13. Nonresident Partner's Income.

gross income. (The Utah portion may be shown alongside the

Complete Schedule A to determine the Utah income amount for

total for each item amount as an attachment to the return.)

non-resident partners. If the partnership does business both

(b) In determining the sources of a nonresident partner's/

within and outside of Utah, the portion of the non-resident

member's income, no consideration will be given to a provision

partnership income attributable to Utah is determined by

in the partnership/LLP/LLC that:

completing Schedule B and then Schedule A.

(1) Characterizes payments to the partner/member as

being for services or for the use of capital, or allocates to the

14. Modifications.

partner/member, as income or gain from sources outside this

state, a greater portion of his distributive share of

Instructions 10(c) and 11(c) discuss modifications which may

partnership/LLP/LLC income or gain than the ratio of

be needed to determine the state taxable income of a

partnership/LLP/LLC income or gain from sources outside this

partner/member.

state to partnership/LLP/LLC income or gain from all sources,

except as provided for in 11(d);

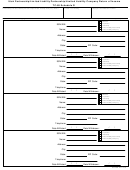

15. Partnerships/LLPs/LLCs may file a composite income

(2) Allocates to the partner/member a greater portion of a

tax return (lines 7 through 12 of form TC-65) on behalf of

partnership/LLP/LLC item, loss or deduction connected with

individual nonresident partners/members that meet the

sources in this state than his porportionate share, for federal

following conditions:

income tax purposes, of partnership loss or deduction

(a) Only individual nonresident partners/members with no

generally, except as provided in 11(d).

other income from Utah sources may be included on the return.

(c) Any modification (such as for U.S. government bond

Nonresident members listed on the return may not file a Utah

interest) that relates to an item of partnership/LLP/LLC income,

individual income tax return. Resident partners/members may

gain, loss, or deduction, shall be made in accordance with the

not be included on lines 7 through 12 of the return.

partner's/member's distributive share for federal income tax

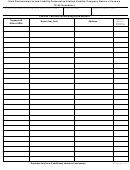

(b) Schedule N must be included with the return. The

purposes of the item to which the modification related, but

schedule shall list the information indicated for all individual

limited to the portion of such item derived from or connected

nonresident partners/members included in the composite filing.

with sources in this state.

(c) If individual nonresident partners/members have other

(d) The Utah State Tax Commission may, on application,

sources of Utah income or are entitled to credits, such as

authorize the use of other methods of determining a

credits for mineral production taxes withheld, agricultural

nonresident partner's/member's portion of a partnership/LLP/

off-highway gas credits, or other Utah credits, those partners/

LLC item derived from or connected with sources in this state,

members must file an individual TC-40. They cannot be

and the modification related thereto, as may be appropriate and

included in the composite filing. Refunds will not be issued or

equitable, on such terms and conditions as it may require.

allowed on composite returns filed.

(e) A nonresident partner's/member's distributive share of

items of income, gain, loss or deduction shall be determined as

16. The tax shall be computed using the maximum tax rate

provided in instruction 10(c) above. The character of

applied to Utah taxable income attributable to Utah

partnership/LLP/LLC items for a nonresident partner/member

sources after allowing the following:

(a) A deduction equal to 15 percent of the Utah taxable

shall also be determined as provided in instruction 10(a) above.

income attributable to nonresident partners/members included

The effect of a special provision in a partnership/LLP/ LLC

in the composite filing.

agreement, other than a provision referred to in 11(b) above,

(b) No deductions shall be allowed for standard deductions

having as a principal purpose the avoidance or evasion of tax,

or itemized deductions, personal exemptions, federal tax

shall be determined as provided in instruction 10(b) above.

determined for the same period, or any other deductions except

12. Mineral producers or payers.

as specified in 15(a).

If the partnership/LLP/LLC is a producer or other person paying

17. Additional Information.

proceeds in connection with mineral properties located within

Utah, the partnership/LLP/LLC must report to each

Additional information concerning Utah income tax

partner/member the partner's/member's share of mineral

requirements as they affect partnerships/LLPs/LLCs and

production withholding tax withheld and remitted to the Utah

partnership/LLP/LLC returns are contained in the Utah Code

State Tax Commission. Parts "B" and "C" of form TC-675R

and the rules of the Utah State Tax Commission.

must be furnished by the producer to the recipients. The

18. Rounding Off To Whole Dollar Amounts.

recipient will take credit against the tax for the amount withheld

All entries must be reported in whole dollar amounts.

and attach copy "B" to the Utah individual income tax return,

fudiciary tax return or corporation tax return. The recipient must

retain copy "C" for verification of the amounts of tax withheld by

If you need an accommodation under the Americans with

Disabilities Act, contact the Tax Commission at (801)297-3811

the producer.

or Telecommunication Device for the Deaf (TDD) (801)

297-3819. Please allow three working days for a response.

65i2.frm Rev. 12/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10