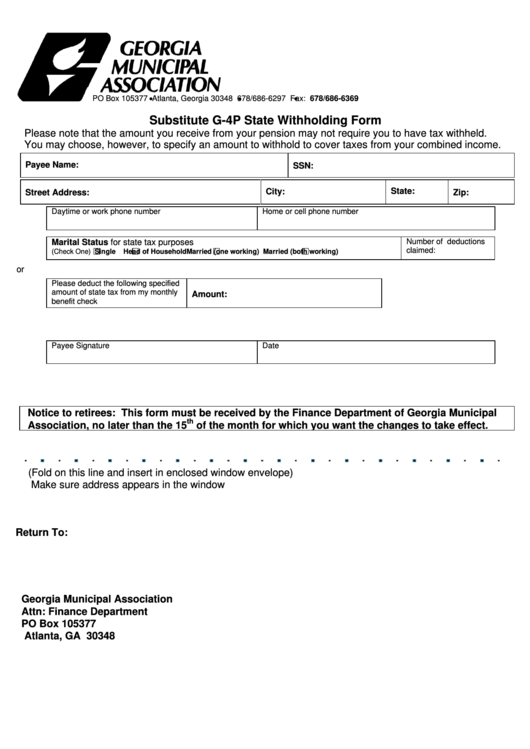

Substitute G-4p State Withholding Form

ADVERTISEMENT

PO Box 105377 Atlanta, Georgia 30348 678/686-6297 Fax: 678/686-6369

Substitute G-4P State Withholding Form

Please note that the amount you receive from your pension may not require you to have tax withheld.

You may choose, however, to specify an amount to withhold to cover taxes from your combined income.

SSN:

Payee Name:

Street Address:

State:

Zip:

City:

Daytime or work phone number

Home or cell phone number

Number of deductions

Marital Status for state tax purposes

(Check One)

Single

Head of Household

Married (one working)

Married (both working)

claimed:

or

(Check One)

Please deduct the following specified

amount of state tax from my monthly

Amount:

benefit check

Payee Signature

Date

Notice to retirees: This form must be received by the Finance Department of Georgia Municipal

th

Association, no later than the 15

of the month for which you want the changes to take effect.

(Fold on this line and insert in enclosed window envelope)

Make sure address appears in the window

Return To:

Georgia Municipal Association

Attn: Finance Department

PO Box 105377

Atlanta, GA 30348

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1