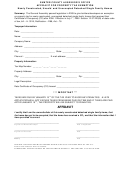

Basic Star Property Tax Exemption Application - Nassau County - 2017-2018 Page 2

ADVERTISEMENT

Page 2

OVERVIEW

The New York State BASIC School Tax Relief (STAR) Program provides an exemption from

school taxes for owner-occupied, primary residences of one, two or three-family homes, mobile

homes, farm homes, condominiums, cooperative apartments or multiple use properties of which

a portion is used, by the owner, as a primary residence.

The BASIC STAR Exemption is for all homeowners, regardless of age whose income is less

than $500,000, including senior citizens whose income does not qualify for the Enhanced

STAR. You must re-file for Basic STAR when your primary residence or the Deed to the

property changes. You must notify the Assessor, in writing within 60 days of the date of

transfer, to remove any exemption(s) on a previous residence prior to filing a new application.

This exemption is not transferable. Homeowners are eligible to receive only one STAR

Exemption within New York State.

APPLICATION INSTRUCTIONS

1. Fill out the application completely. If not already pre-printed, enter your name, address and

property identification. Failure to provide a Social Security number may cause your

application to be denied.

2. Name on the Deed or Certificate of Shares must correspond with the name on the

application. If the name does not match, proof of ownership (i.e. Probated Will; Trust; etc.)

must be submitted.

3. Attach a copy of the deed. Cooperative apartment owners must attach a copy of the

Certificate of Shares.

4. Attach a copy of proof of primary residence (i.e. Car Registration; Voter Registration

Card; 2015 NYS Income Tax Return; Driver’s License; Non-Driver’s Identification

Card.) Proof of residency must show the current address as listed above.

5. If the property is in a Life Estate, the Life Estate holder must sign and supply the proof of

residency.

6. A copy of the Probated Will (If the owner(s) on the Deed is/are deceased)

7. A copy of the entire Trust (If the property has been placed in a Trust)

CAUTION: Anyone who misrepresents his or her primary residence may be subject to

penalty of either one hundred dollars or twenty percent of the improperly received tax

savings, whichever is greater, with such fine not to exceed two thousand five hundred

dollars. Additionally, such individual will be prohibited from receiving the STAR

Exemption for five years, and may be subject to criminal prosecution.

The completed application must be filed with the Nassau County Department of Assessment on

or before the taxable status date of January 2, 2017.

Para asistencia en Español llame al (516) 571-2020

NASSAU COUNTY DEPARTMENT OF ASSESSMENT

th

240 OLD COUNTRY ROAD, 4

FLOOR

MINEOLA, NEW YORK 11501

(516) 571-1500

Rev. 2/16

NC-425

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2