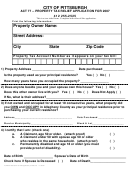

Property Tax Exemption Application For Qualifying Disabled Veterans

ADVERTISEMENT

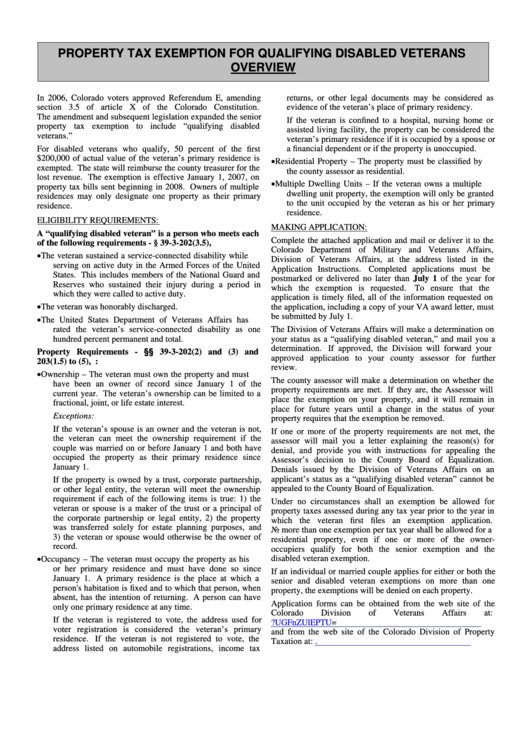

PROPERTY TAX EXEMPTION FOR QUALIFYING DISABLED VETERANS

OVERVIEW

In 2006, Colorado voters approved Referendum E, amending

returns, or other legal documents may be considered as

section 3.5 of article X of the Colorado Constitution.

evidence of the veteran’s place of primary residency.

The amendment and subsequent legislation expanded the senior

If the veteran is confined to a hospital, nursing home or

property tax exemption to include “qualifying disabled

assisted living facility, the property can be considered the

veterans.”

veteran’s primary residence if it is occupied by a spouse or

For disabled veterans who qualify, 50 percent of the first

a financial dependent or if the property is unoccupied.

$200,000 of actual value of the veteran’s primary residence is

•

Residential Property – The property must be classified by

exempted. The state will reimburse the county treasurer for the

the county assessor as residential.

lost revenue. The exemption is effective January 1, 2007, on

•

Multiple Dwelling Units – If the veteran owns a multiple

property tax bills sent beginning in 2008. Owners of multiple

dwelling unit property, the exemption will only be granted

residences may only designate one property as their primary

to the unit occupied by the veteran as his or her primary

residence.

residence.

ELIGIBILITY REQUIREMENTS:

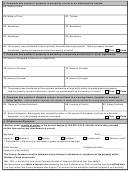

MAKING APPLICATION:

A “qualifying disabled veteran” is a person who meets each

Complete the attached application and mail or deliver it to the

of the following requirements - § 39-3-202(3.5), C.R.S.

Colorado Department of Military and Veterans Affairs,

•

The veteran sustained a service-connected disability while

Division of Veterans Affairs, at the address listed in the

serving on active duty in the Armed Forces of the United

Application Instructions.

Completed applications must be

States. This includes members of the National Guard and

postmarked or delivered no later than July 1 of the year for

Reserves who sustained their injury during a period in

which the exemption is requested.

To ensure that the

which they were called to active duty.

application is timely filed, all of the information requested on

•

The veteran was honorably discharged.

the application, including a copy of your VA award letter, must

be submitted by July 1.

•

The United States Department of Veterans Affairs has

rated the veteran’s service-connected disability as one

The Division of Veterans Affairs will make a determination on

hundred percent permanent and total.

your status as a “qualifying disabled veteran,” and mail you a

determination. If approved, the Division will forward your

Property Requirements - §§ 39-3-202(2) and (3) and

approved application to your county assessor for further

203(1.5) to (5), C.R.S:

review.

•

Ownership – The veteran must own the property and must

The county assessor will make a determination on whether the

have been an owner of record since January 1 of the

property requirements are met. If they are, the Assessor will

current year. The veteran’s ownership can be limited to a

place the exemption on your property, and it will remain in

fractional, joint, or life estate interest.

place for future years until a change in the status of your

Exceptions:

property requires that the exemption be removed.

If the veteran’s spouse is an owner and the veteran is not,

If one or more of the property requirements are not met, the

the veteran can meet the ownership requirement if the

assessor will mail you a letter explaining the reason(s) for

couple was married on or before January 1 and both have

denial, and provide you with instructions for appealing the

occupied the property as their primary residence since

Assessor’s decision to the County Board of Equalization.

January 1.

Denials issued by the Division of Veterans Affairs on an

applicant’s status as a “qualifying disabled veteran” cannot be

If the property is owned by a trust, corporate partnership,

appealed to the County Board of Equalization.

or other legal entity, the veteran will meet the ownership

requirement if each of the following items is true: 1) the

Under no circumstances shall an exemption be allowed for

veteran or spouse is a maker of the trust or a principal of

property taxes assessed during any tax year prior to the year in

the corporate partnership or legal entity, 2) the property

which the veteran first files an exemption application.

was transferred solely for estate planning purposes, and

No more than one exemption per tax year shall be allowed for a

3) the veteran or spouse would otherwise be the owner of

residential property, even if one or more of the owner-

record.

occupiers qualify for both the senior exemption and the

•

disabled veteran exemption.

Occupancy – The veteran must occupy the property as his

or her primary residence and must have done so since

If an individual or married couple applies for either or both the

January 1. A primary residence is the place at which a

senior and disabled veteran exemptions on more than one

person's habitation is fixed and to which that person, when

property, the exemptions will be denied on each property.

absent, has the intention of returning. A person can have

Application forms can be obtained from the web site of the

only one primary residence at any time.

Colorado

Division

of

Veterans

Affairs

at:

If the veteran is registered to vote, the address used for

voter registration is considered the veteran’s primary

and from the web site of the Colorado Division of Property

residence. If the veteran is not registered to vote, the

Taxation at:

address listed on automobile registrations, income tax

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4