❑

❑

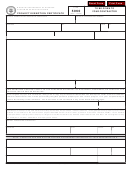

MAILING LISTS

LOCOMOTIVE FUEL

Sales Tax License No. __ __ _ __ __ _ __ _ __ _

Sales Tax License No. _ ___ ____ ___ _ _ _ _ _

I certify the printed mailing lists or electronic databases are used to

I certify this fuel will be used by a railroad in a locomotive engine.

send printed material that is delivered by U.S. mail or other delivery

❑

SEMICONDUCTOR FABRICATING, PROCESSING, OR

service to a mass audience where the cost of the printed material is

not billed directly to the recipients.

RESEARCH AND DEVELOPMENT MATERIAL

❑

Sales Tax License No. _ ___ ____ ___ _ _ _ _ _

OUT-OF-STATE CONSTRUCTION MATERIALS

I certify the fabricating, processing, or research and development

I certify this tangible personal property will be shipped out of state

materials purchased are for use in research or development, manufac-

and will become part of real property located in a state that does not

turing, or fabricating of semiconductors.

have a sales tax or allow credit for tax paid to Utah.

❑

❑

AIRCRAFT MAINTENANCE, REPAIR & OVERHAUL PROVIDER

CONSTRUCTION MATERIALS PURCHASED FOR AIRPORTS

Sales Tax License No. _ ___ ____ ___ _ _ _ _ _

I certify the construction materials are purchased by, on behalf of, or

I certify these sales are to or by an aircraft maintenance, repair and

for the benefit of Salt Lake International Airport, or a new airport

overhaul provider for the use in the maintenance, repair, overhaul or

owned or operated by a city in Davis, Utah, Washington or Weber

refurbishment in Utah of a fixed-wing, turbine-powered aircraft that

County. I further certify the construction materials will be installed or

is registered or licensed in a state or country outside Utah.

converted into real property owned by and located at the airport.

❑

❑

SKI RESORT

CONSTRUCTION MATERIALS PURCHASED FOR RELIGIOUS

Sales Tax License No. __ ___ ___ ____ _ _ _ _

AND CHARITABLE ORGANIZATIONS

I certify the snow-making equipment, ski slope grooming equipment

I certify the construction materials are purchased on behalf of a religious

or passenger rope-ways purchased are to be paid directly with

or charitable organization and that they will be installed or converted into

funds from the ski resort noted on the front of this form.

real property owned by the religious or charitable organization.

❑

Name of religious or charitable organization:

TOURISM/MOTOR VEHICLE RENTAL

_ __ _ _ _ _ _ _ _ ___ __ __ __________ __ _ __

I certify the motor vehicle being leased or rented will be temporarily

used to replace a motor vehicle that is being repaired pursuant to a

Sales Tax License No. ________________________________

repair or an insurance agreement; the lease will exceed 30 days;

Name of project: _ _ ___ __ __ __ _ __ __ _ __ __ _ _

the motor vehicle being leased or rented is registered for a gross

❑

laden weight of 12,001 pounds or more; or, the motor vehicle is

MACHINERY AND EQUIPMENT AND NORMAL OPERATING

being rented or leased as a personal household goods moving van.

REPAIR OR REPLACEMENT PARTS USED IN A MANUFACTUR-

This exemption applies only to the tourism tax (up to 7 percent) and

ING FACILITY, MINING ACTIVITY OR WEB SEARCH PORTAL

the short-term motor vehicle rental tax (Transportation Corridor

OR ELECTRONIC FINANCIAL PAYMENT SERVICE

Funding – 2.5 percent) – not to the state, local, transit, zoo, hospital,

Sales Tax License No. __ __ _ __ __ _ __ _ __ _

highways, county option or resort sales tax.

I certify the machinery and equipment and normal operating repair

❑

TELECOMMUNICATIONS EQUIPMENT, MACHINERY OR

or replacement parts have an economic life of three years or more

and are for use in a Utah manufacturing facility described in SIC

SOFTWARE

Codes 2000-3999; in a qualifying scrap recycling operation; in a

Sales Tax License No. _ ___ ____ ___ _ _ _ _ _

cogeneration facility placed in service on or after May 1, 2006; in the

I certify these purchases or leases of equipment, machinery, or

operation of a Web search portal by a new or expanding business

software, by or on behalf of a telephone service provider, have a

described in NAICS Code 518112 between July 1, 2010 and June

useful economic life of one or more years and will be used to enable

30, 2014; in the operation of an electronic financial payment service

or facilitate telecommunications; to provide 911 service; to maintain

described in NAICS Code 522320; or in a business described in

or repair telecommunications equipment; to switch or route

NAICS 212, Mining (except Oil and Gas), or NAICS 213113,

telecommunications service; or for sending, receiving, or transport-

Support Activities for Coal Mining, NAICS 213114, Support Activi-

ing telecommunications service.

ties for Metal Mining, or NAICS 213115, Support Activities for

❑

Nonmetallic Minerals (except Fuels) Mining. For a definition of

TEXTBOOKS FOR HIGHER EDUCATION

exempt mining equipment, see Utah Code §59-12-104(14).

I certify that textbooks purchased are required for a higher education

❑

course, for which I am enrolled at an institution of higher education,

RESEARCH AND DEVELOPMENT OF ALTERNATIVE ENERGY

and qualify for this exemption. An institution of higher education

TECHNOLOGY

means: the University of Utah, Utah State University, Utah State

Sales Tax License No. __ __ _ __ __ _ __ _ __ _

University Eastern, Weber State University, Southern Utah Univer-

I certify the tangible personal property purchased will be used in

sity, Snow College, Dixie State University, Utah Valley University, Salt

research and development of alternative energy technology.

Lake Community College, or the Utah College of Applied Technology.

❑

❑

LIFE SCIENCE RESEARCH AND DEVELOPMENT FACILITY

MACHINERY OR EQUIPMENT USED BY PAYERS OF

Sales Tax License No. __ __ _ __ __ _ __ _ __ _

ADMISSIONS OR USER FEES

I certify that: (1) the machinery, equipment and normal operating repair

Sales Tax License No. _ ___ ____ ___ _ _ _ _ _

or replacement parts purchased have an economic life of three or more

I certify that: (1) the machinery or equipment has an economic life

of three or more years and will be used by payers of admissions or

years for use in performing qualified research in Utah; or (2) construc-

user fees (Utah Code §59-12-103(1)(f)); (2) the buyer is in the

tion materials purchased are for use in the construction of a new or

amusement, gambling or recreation industry (NAICS Subsector

expanding life science research and development facility in Utah.

713); and (3) at least 51 percent of the buyer’s sales revenue for the

❑

previous calendar quarter came from admissions or user fees.

AGRICULTURAL PRODUCER

❑

I certify the items purchased will be used primarily and directly in a

SHORT-TERM LODGING CONSUMABLES

commercial farming operation and qualify for the Utah sales and use

Sales Tax License No. _ ___ ____ ___ _ _ _ _ _

tax exemption. THIS EXEMPTION DOES NOT APPLY TO VEHICLES

I certify the tangible personal property is consumable items

REQUIRED TO BE REGISTERED.

purchased by a lodging provider as described in Utah Code

§59-12-103(1)(i).

Print Form

NOTE TO PURCHASER: You must notify the seller of cancellation, modification, or limitation of the exemption you have claimed.

Questions? Email taxmaster@utah.gov, or call 801-297-2200 or 1-800-662-4335.

If you need an accommodation under the Americans with Disabilities Act, email taxada@utah.gov, or call 801-297-3811 or TDD 801-297-2020.

Please allow three working days for a response.

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2