Independent Contractor Attestation

ADVERTISEMENT

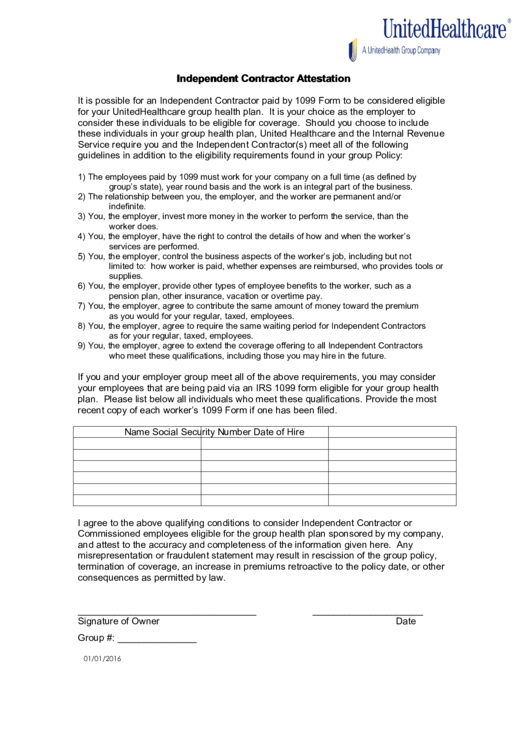

Independent Contractor Attestation

It is possible for an Independent Contractor paid by 1099 Form to be considered eligible

for your UnitedHealthcare group health plan. It is your choice as the employer to

consider these individuals to be eligible for coverage. Should you choose to include

these individuals in your group health plan, United Healthcare and the Internal Revenue

Service require you and the Independent Contractor(s) meet all of the following

guidelines in addition to the eligibility requirements found in your group Policy:

1)

The employees paid by 1099 must work for your company on a full time (as defined by

group’s state), year round basis and the work is an integral part of the business.

2)

The relationship between you, the employer, and the worker are permanent and/or

indefinite.

3)

You, the employer, invest more money in the worker to perform the service, than the

worker does.

4)

You, the employer, have the right to control the details of how and when the worker’s

services are performed.

5)

You, the employer, control the business aspects of the worker’s job, including but not

limited to: how worker is paid, whether expenses are reimbursed, who provides tools or

supplies.

6)

You, the employer, provide other types of employee benefits to the worker, such as a

pension plan, other insurance, vacation or overtime pay.

7)

You, the employer, agree to contribute the same amount of money toward the premium

as you would for your regular, taxed, employees.

8)

You, the employer, agree to require the same waiting period for Independent Contractors

as for your regular, taxed, employees.

9)

You, the employer, agree to extend the coverage offering to all Independent Contractors

who meet these qualifications, including those you may hire in the future.

If you and your employer group meet all of the above requirements, you may consider

your employees that are being paid via an IRS 1099 form eligible for your group health

plan. Please list below all individuals who meet these qualifications. Provide the most

recent copy of each worker’s 1099 Form if one has been filed.

Name

Social Security Number

Date of Hire

I agree to the above qualifying conditions to consider Independent Contractor or

Commissioned employees eligible for the group health plan sponsored by my company,

and attest to the accuracy and completeness of the information given here. Any

misrepresentation or fraudulent statement may result in rescission of the group policy,

termination of coverage, an increase in premiums retroactive to the policy date, or other

consequences as permitted by law.

__________________________________

_____________________

Signature of Owner

Date

Group #: _______________

01/01/2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1