Deduction Checklist

ADVERTISEMENT

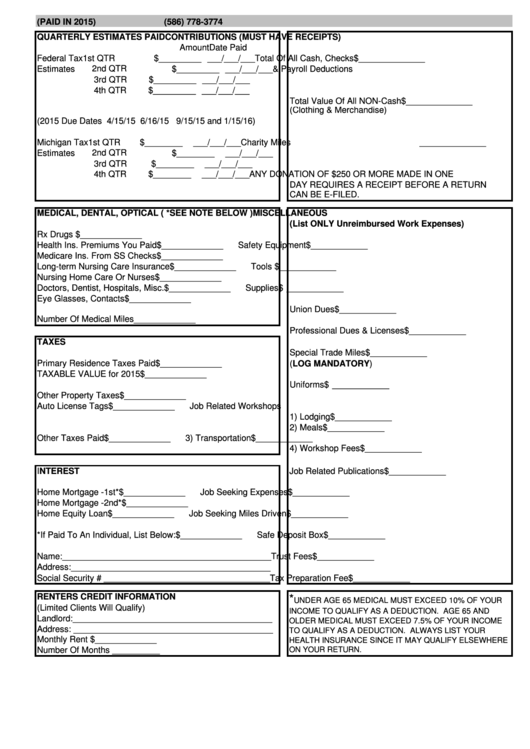

DEDUCTION CHECKLIST (PAID IN 2015)

(586) 778-3774

QUARTERLY ESTIMATES PAID

CONTRIBUTIONS (MUST HAVE RECEIPTS)

Amount

Date Paid

Federal Tax

1st QTR

$ _________ ___/___/___

Total Of All Cash, Checks

$______________

Estimates

2nd QTR

$ _________ ___/___/___

& Payroll Deductions

3rd QTR

$ _________ ___/___/___

4th QTR

$ _________ ___/___/___

Total Value Of All NON-Cash

$______________

(Clothing & Merchandise)

(2015 Due Dates 4/15/15 6/16/15 9/15/15 and 1/15/16)

Michigan Tax 1st QTR

$ ________

___/___/___

Charity Miles

______________

Estimates

2nd QTR

$ ________

___/___/___

3rd QTR

$ ________

___/___/___

4th QTR

$ ________

___/___/___

ANY DONATION OF $250 OR MORE MADE IN ONE

DAY REQUIRES A RECEIPT BEFORE A RETURN

CAN BE E-FILED.

MEDICAL, DENTAL, OPTICAL ( *SEE NOTE BELOW )

MISCELLANEOUS

(List ONLY Unreimbursed Work Expenses)

Rx Drugs

$ _____________

Health Ins. Premiums You Paid

$ _____________

Safety Equipment

$ ____________

Medicare Ins. From SS Checks

$ _____________

Long-term Nursing Care Insurance

$ _____________

Tools

$ ____________

Nursing Home Care Or Nurses

$ _____________

Doctors, Dentist, Hospitals, Misc.

$ _____________

Supplies

$ ____________

Eye Glasses, Contacts

$ _____________

Union Dues

$ ____________

Number Of Medical Miles

_____________

Professional Dues & Licenses

$ ____________

TAXES

Special Trade Miles

$ ____________

Primary Residence Taxes Paid

$ _____________

(LOG MANDATORY)

TAXABLE VALUE for 2015

$ _____________

Uniforms

$ ____________

Other Property Taxes

$ _____________

Auto License Tags

$ _____________

Job Related Workshops

1) Lodging

$ ____________

2) Meals

$ ____________

Other Taxes Paid

$ _____________

3) Transportation

$ ____________

4) Workshop Fees

$ ____________

INTEREST

Job Related Publications

$ ____________

Home Mortgage -1st*

$ _____________

Job Seeking Expenses

$ ____________

Home Mortgage -2nd*

$ _____________

Home Equity Loan

$ _____________

Job Seeking Miles Driven

$ ____________

*If Paid To An Individual, List Below:

$ _____________

Safe Deposit Box

$ ____________

Name:____________________________________________

Trust Fees

$ ____________

Address:__________________________________________

Social Security # ___________________________________

Tax Preparation Fee

$ ____________

RENTERS CREDIT INFORMATION

*

UNDER AGE 65 MEDICAL MUST EXCEED 10% OF YOUR

(Limited Clients Will Qualify)

INCOME TO QUALIFY AS A DEDUCTION. AGE 65 AND

Landlord:__________________________________________

OLDER MEDICAL MUST EXCEED 7.5% OF YOUR INCOME

Address: __________________________________________

TO QUALIFY AS A DEDUCTION. ALWAYS LIST YOUR

Monthly Rent

$ _____________

HEALTH INSURANCE SINCE IT MAY QUALIFY ELSEWHERE

Number Of Months __________

ON YOUR RETURN.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1