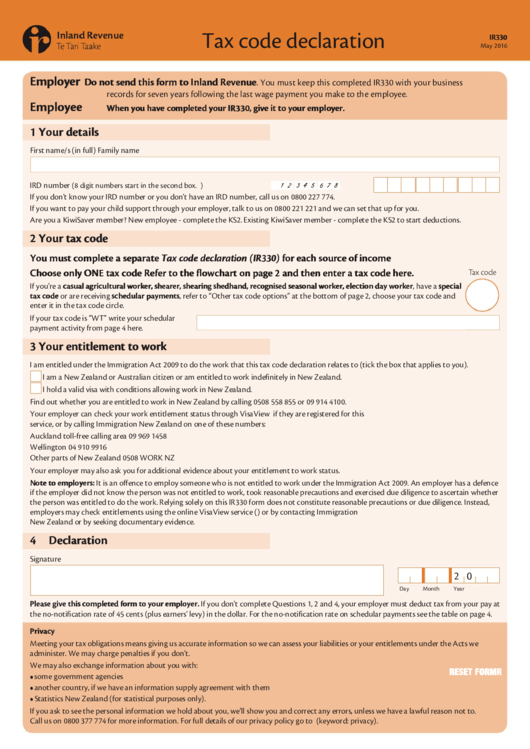

Tax code declaration

IR330

May 2016

Employer

Do not send this form to Inland Revenue

. You must keep this completed IR330 with your business

records for seven years following the last wage payment you make to the employee.

Employee

When you have completed your IR330, give it to your employer.

1 Your details

First name/s (in full)

Family name

IRD number

(8 digit numbers start in the second box.

)

If you don't know your IRD number or you don't have an IRD number, call us on 0800 227 774.

If you want to pay your child support through your employer, talk to us on 0800 221 221 and we can set that up for you.

Are you a KiwiSaver member? New employee - complete the KS2. Existing KiwiSaver member - complete the KS2 to start deductions.

2 Your tax code

You must complete a separate Tax code declaration (IR330) for each source of income

Choose only ONE tax code

Refer to the flowchart on page 2 and then enter a tax code here.

If you're a casual agricultural worker, shearer, shearing shedhand, recognised seasonal worker, election day worker, have a special

tax code or are receiving schedular payments, refer to “Other tax code options” at the bottom of page 2, choose your tax code and

enter it in the tax code circle.

If your tax code is ”WT” write your schedular

payment activity from page 4 here.

3 Your entitlement to work

I am entitled under the Immigration Act 2009 to do the work that this tax code declaration relates to (tick the box that applies to you).

I am a New Zealand or Australian citizen or am entitled to work indefinitely in New Zealand.

I hold a valid visa with conditions allowing work in New Zealand.

Find out whether you are entitled to work in New Zealand by calling 0508 558 855 or 09 914 4100.

Your employer can check your work entitlement status through VisaView if they are registered for this

service, or by calling Immigration New Zealand on one of these numbers:

Auckland toll-free calling area

09 969 1458

Wellington

04 910 9916

Other parts of New Zealand

0508 WORK NZ

Your employer may also ask you for additional evidence about your entitlement to work status.

Note to employers: It is an offence to employ someone who is not entitled to work under the Immigration Act 2009. An employer has a defence

if the employer did not know the person was not entitled to work, took reasonable precautions and exercised due diligence to ascertain whether

the person was entitled to do the work. Relying solely on this IR330 form does not constitute reasonable precautions or due diligence. Instead,

employers may check entitlements using the online VisaView service ( ) or by contacting Immigration

New Zealand or by seeking documentary evidence.

4 Declaration

Signature

2 0

Day

Month

Year

Please give this completed form to your employer. If you don't complete Questions 1, 2 and 4, your employer must deduct tax from your pay at

the no-notification rate of 45 cents (plus earners' levy) in the dollar. For the no-notification rate on schedular payments see the table on page 4.

Privacy

Meeting your tax obligations means giving us accurate information so we can assess your liabilities or your entitlements under the Acts we

administer. We may charge penalties if you don't.

We may also exchange information about you with:

RESET FORM

RESET FORM

•

some government agencies

•

another country, if we have an information supply agreement with them

•

Statistics New Zealand (for statistical purposes only).

If you ask to see the personal information we hold about you, we'll show you and correct any errors, unless we have a lawful reason not to.

Call us on 0800 377 774 for more information. For full details of our privacy policy go to (keyword: privacy).

1

1 2

2 3

3 4

4