Print

Submit by Email

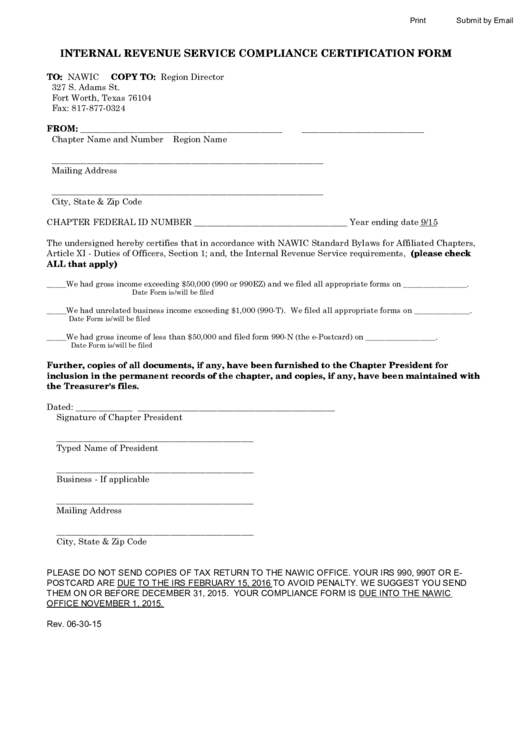

INTERNAL REVENUE SERVICE COMPLIANCE CERTIFICATION FORM

TO:

NAWIC

COPY TO: Region Director

327 S. Adams St.

Fort Worth, Texas 76104

Fax: 817-877-0324

FROM:

______________________________________________

____________________________

Chapter Name and Number

Region Name

______________________________________________________________

Mailing Address

______________________________________________________________

City, State & Zip Code

CHAPTER FEDERAL ID NUMBER ___________________________________ Year ending date 9/15

The undersigned hereby certifies that in accordance with NAWIC Standard Bylaws for Affiliated Chapters,

Article XI - Duties of Officers, Section 1; and, the Internal Revenue Service requirements, (please check

ALL that apply)

_____We had gross income exceeding $50,000 (990 or 990EZ) and we filed all appropriate forms on ________________.

Date Form is/will be filed

_____We had unrelated business income exceeding $1,000 (990-T). We filed all appropriate forms on ______________.

Date Form is/will be filed

_____We had gross income of less than $50,000 and filed form 990-N (the e-Postcard) on __________________.

Date Form is/will be filed

Further, copies of all documents, if any, have been furnished to the Chapter President for

inclusion in the permanent records of the chapter, and copies, if any, have been maintained with

the Treasurer's files.

Dated: _____________

_____________________________________________

Signature of Chapter President

_____________________________________________

Typed Name of President

_____________________________________________

Business - If applicable

_____________________________________________

Mailing Address

_____________________________________________

City, State & Zip Code

PLEASE DO NOT SEND COPIES OF TAX RETURN TO THE NAWIC OFFICE. YOUR IRS 990, 990T OR E-

POSTCARD ARE DUE TO THE IRS FEBRUARY 15, 2016 TO AVOID PENALTY. WE SUGGEST YOU SEND

THEM ON OR BEFORE DECEMBER 31, 2015. YOUR COMPLIANCE FORM IS DUE INTO THE NAWIC

OFFICE NOVEMBER 1, 2015.

Rev. 06-30-15

1

1