Return To Form

Instructions for Page 2, Breakdown of R&D Expenditures by Location

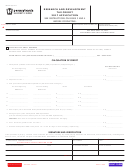

PART I, Page 2

Line 1:

Column 3 – List the Total Qualified Research Expenses from Section A, Section B or Section C of federal Form 6765.

Line 2: Location A

Column 1 – List PA-qualified R&D expenditures for that location.

Column 2 – List PA expenditures located in a KOZ.

Column 3 – List total PA expenditures (sum of Columns 1 and 2).

Column 4 – List percent of federal expense (Line 1, Column 3).

Lines 3 through 6 should be completed for additional PA locations (if more than five locations, make a clean copy of Page 2 to report additional

locations).

Line 7:

Column 3 – List total Non-PA R&D expenditures.

Column 4 – List percent of federal expense (Line 1, Column 3).

Line 8:

Column 1 – Total PA-qualified R&D expenditures (this amount should match “Actual” amount on Line 1 of Page 1).

Column 3 – Total R&D expenditures everywhere.

PART II

List address for each location (A, B, etc.).

PART III

List contact’s name, employer’s name, telephone number, fax number and email address for each location (A, B, etc.). Check the box if the research

was performed by a third party.

NOTE: Complete Page 2 of the R&D application even if all expenses were incurred in PA.

Please carry all totals to the bottom of each column, Part I, Page 2 of the R&D application.

For information on this and other saleable restricted tax credit programs, please visit the Department of Revenue’s Online Customer

Service Center and/or review Corporation Tax Bulletin 2014-04, both accessible at Questions regarding

completion of the application and the calculation of the credit may be directed to 717-705-6225, Option 5, then Option 2.

Do not include this application with the filing of your RCT-101, PA Corporate Net Income Tax Report.

CAUTION: You MUST email your REV-545 and any attachments to ra-rvpacorprd@pa.gov.

CAUTION: When emailing, your application with any supporting documentation must be one document in PDF format to ensure timely and

accurate processing.

If submitting more than one application, each application must be a separate attachment in your email.

CHECKLIST:

Before submitting your application, please review the items below and put an X next to each item after you have verified it is complete. This will

help to avoid a delay or denial of your application.

_____1. Page 1 and Page 2 (all three parts) of the REV-545 have been filled out in their entirety.

_____2. Included is a copy of federal Form 6765 or a pro forma copy of federal Form 6765 for each year listed with expenditures. Expenditures

are listed under Line 1 and Line 3 on Page 1 of REV-545. *

_____3. Included is a completed Page 2 of REV-545 for each year listed with expenditures. Expenditures are listed under Line 1 and Line 3 on

Page 1 of REV-545.*

_____4. Included is a written explanation of the difference(s) in R&D expenditures between this year’s expenditures and prior filings of REV-545,

if applicable. Supporting documentation is also included.

_____5. If filing as a small business, included is a copy of the balance sheet showing total assets less than $5 million at the beginning or end of

the year.

*NOTE: Only provide items 2 and 3 above for years that had changes in expenditures or years for which this information was not already provided

in prior filings of REV-545. However, you must always provide this information for the base year expenditures listed on Line 1 of Page 1.

REV-545, PAGE 4 of 4

Reset Entire Form

RETURN TO TOP

PREVIOUS PAGE

PRINT FORM

1

1 2

2 3

3 4

4