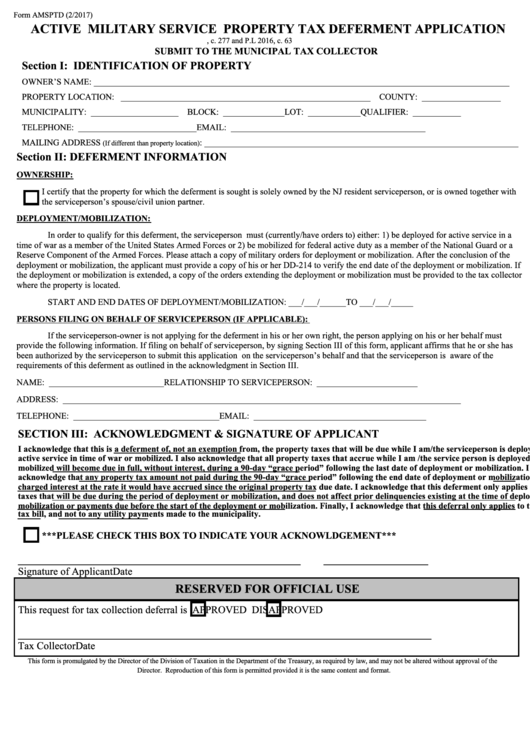

Form AMSPTD (2/2017)

ACTIVE MILITARY SERVICE PROPERTY TAX DEFERMENT APPLICATION

P.L. 2015, c. 277 and P.L 2016, c. 63

SUBMIT TO THE MUNICIPAL TAX COLLECTOR

Section I: IDENTIFICATION OF PROPERTY

OWNER’S NAME: ______________________________________________________________________________________________

PROPERTY LOCATION: _________________________________________________________ COUNTY: __________________

MUNICIPALITY: ____________________ BLOCK: ______________

LOT: ____________

QUALIFIER: ___________

TELEPHONE: ___________________________

EMAIL: ____________________________________________

MAILING ADDRESS

: _______________________________________________________________________

(If different than property location)

Section II: DEFERMENT INFORMATION

OWNERSHIP:

I certify that the property for which the deferment is sought is solely owned by the NJ resident serviceperson, or is owned together with

the serviceperson’s spouse/civil union partner.

DEPLOYMENT/MOBILIZATION:

In order to qualify for this deferment, the serviceperson must (currently/have orders to) either: 1) be deployed for active service in a

time of war as a member of the United States Armed Forces or 2) be mobilized for federal active duty as a member of the National Guard or a

Reserve Component of the Armed Forces. Please attach a copy of military orders for deployment or mobilization. After the conclusion of the

deployment or mobilization, the applicant must provide a copy of his or her DD-214 to verify the end date of the deployment or mobilization. If

the deployment or mobilization is extended, a copy of the orders extending the deployment or mobilization must be provided to the tax collector

where the property is located.

START AND END DATES OF DEPLOYMENT/MOBILIZATION: ___/___/______

TO

___/___/_____

PERSONS FILING ON BEHALF OF SERVICEPERSON (IF APPLICABLE):

If the serviceperson-owner is not applying for the deferment in his or her own right, the person applying on his or her behalf must

provide the following information. If filing on behalf of serviceperson, by signing Section III of this form, applicant affirms that he or she has

been authorized by the serviceperson to submit this application on the serviceperson’s behalf and that the serviceperson is aware of the

requirements of this deferment as outlined in the acknowledgment in Section III.

NAME: __________________________

RELATIONSHIP TO SERVICEPERSON: _______________________

ADDRESS: __________________________________________________________________________________________

TELEPHONE: _________________________________

EMAIL: _______________________________________

SECTION III: ACKNOWLEDGMENT & SIGNATURE OF APPLICANT

I acknowledge that this is a deferment of, not an exemption from, the property taxes that will be due while I am/the serviceperson is deployed for

active service in time of war or mobilized. I also acknowledge that all property taxes that accrue while I am /the service person is deployed or

mobilized will become due in full, without interest, during a 90-day “grace period” following the last date of deployment or mobilization. I further

acknowledge that any property tax amount not paid during the 90-day “grace period” following the end date of deployment or mobilization will be

charged interest at the rate it would have accrued since the original property tax due date. I acknowledge that this deferment only applies to property

taxes that will be due during the period of deployment or mobilization, and does not affect prior delinquencies existing at the time of deployment or

mobilization or payments due before the start of the deployment or mobilization. Finally, I acknowledge that this deferral only applies to the property

tax bill, and not to any utility payments made to the municipality.

***PLEASE CHECK THIS BOX TO INDICATE YOUR ACKNOWLDGEMENT***

______________________________________________________

____________________

Signature of Applicant

Date

RESERVED FOR OFFICIAL USE

This request for tax collection deferral is

APPROVED

DISAPPROVED

__________________________________________________________

_____________________

Tax Collector

Date

This form is promulgated by the Director of the Division of Taxation in the Department of the Treasury, as required by law, and may not be altered without approval of the

Director. Reproduction of this form is permitted provided it is the same content and format.

1

1 2

2