Sba 504 Needs List

ADVERTISEMENT

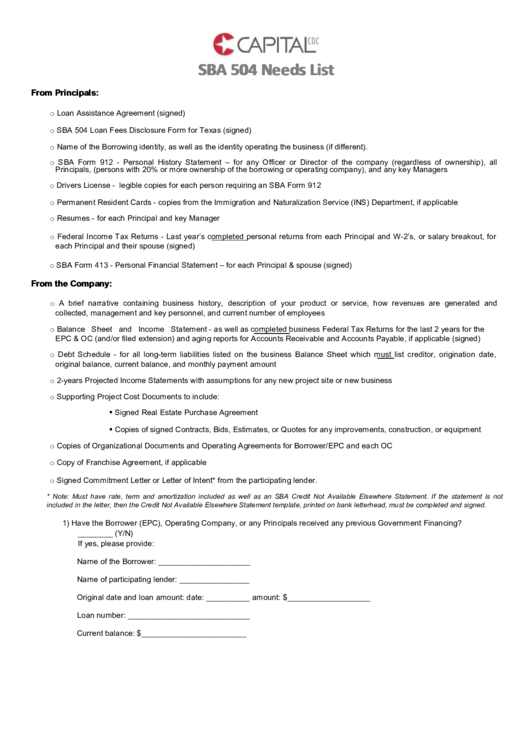

SBA 504 Needs List

From Principals:

o Loan Assistance Agreement (signed)

o SBA 504 Loan Fees Disclosure Form for Texas (signed)

o Name of the Borrowing identity, as well as the identity operating the business (if different).

o SBA Form 912 - Personal History Statement – for any Officer or Director of the company (regardless of ownership), all

Principals, (persons with 20% or more ownership of the borrowing or operating company), and any key Managers

o Drivers License - legible copies for each person requiring an SBA Form 912

o Permanent Resident Cards - copies from the Immigration and Naturalization Service (INS) Department, if applicable

o Resumes - for each Principal and key Manager

o Federal Income Tax Returns - Last year’s completed personal returns from each Principal and W-2’s, or salary breakout, for

each Principal and their spouse (signed)

o SBA Form 413 - Personal Financial Statement – for each Principal & spouse (signed)

From the Company:

o A brief narrative containing business history, description of your product or service, how revenues are generated and

collected, management and key personnel, and current number of employees

o Balance Sheet and Income Statement - as well as completed business Federal Tax Returns for the last 2 years for the

EPC & OC (and/or filed extension) and aging reports for Accounts Receivable and Accounts Payable, if applicable (signed)

o Debt Schedule - for all long-term liabilities listed on the business Balance Sheet which must list creditor, origination date,

original balance, current balance, and monthly payment amount

o 2-years Projected Income Statements with assumptions for any new project site or new business

o Supporting Project Cost Documents to include:

Signed Real Estate Purchase Agreement

Copies of signed Contracts, Bids, Estimates, or Quotes for any improvements, construction, or equipment

o Copies of Organizational Documents and Operating Agreements for Borrower/EPC and each OC

o Copy of Franchise Agreement, if applicable

o Signed Commitment Letter or Letter of Intent* from the participating lender.

* Note: Must have rate, term and amortization included as well as an SBA Credit Not Available Elsewhere Statement. If the statement is not

included in the letter, then the Credit Not Available Elsewhere Statement template, printed on bank letterhead, must be completed and signed.

1)

Have the Borrower (EPC), Operating Company, or any Principals received any previous Government Financing?

________ (Y/N)

If yes, please provide:

Name of the Borrower: _____________________

Name of participating lender: ________________

Original date and loan amount: date: __________ amount: $___________________

Loan number: ____________________________

Current balance: $________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2