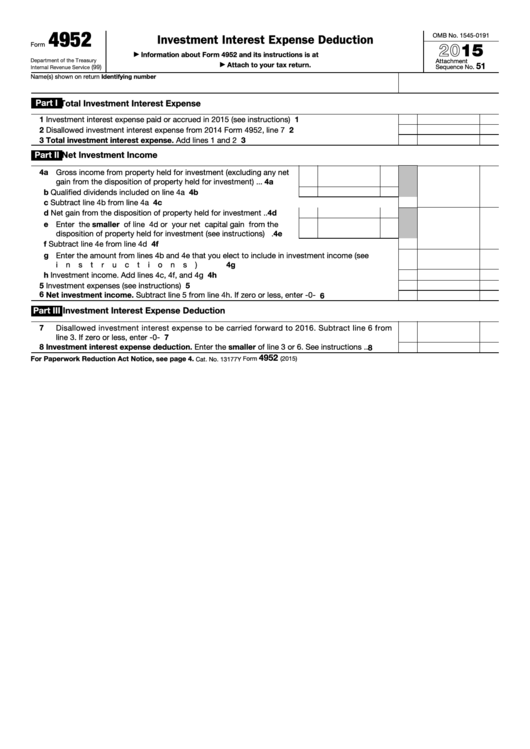

4952

OMB No. 1545-0191

Investment Interest Expense Deduction

2015

Form

Information about Form 4952 and its instructions is at

▶

Department of the Treasury

Attachment

Attach to your tax return.

51

▶

(99)

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

Part I

Total Investment Interest Expense

1

1

Investment interest expense paid or accrued in 2015 (see instructions)

.

.

.

.

.

.

.

.

2

Disallowed investment interest expense from 2014 Form 4952, line 7 .

.

.

.

.

.

.

.

.

2

3

Total investment interest expense. Add lines 1 and 2 .

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Part II

Net Investment Income

4 a Gross income from property held for investment (excluding any net

4a

gain from the disposition of property held for investment) .

.

.

b Qualified dividends included on line 4a .

4b

.

.

.

.

.

.

.

.

c Subtract line 4b from line 4a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4c

d Net gain from the disposition of property held for investment .

.

4d

e Enter the smaller of line 4d or your net capital gain from the

disposition of property held for investment (see instructions)

.

4e

f

Subtract line 4e from line 4d

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4f

g Enter the amount from lines 4b and 4e that you elect to include in investment income (see

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4g

h Investment income. Add lines 4c, 4f, and 4g

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4h

5

5

Investment expenses (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Net investment income. Subtract line 5 from line 4h. If zero or less, enter -0- .

.

.

.

.

.

6

Part III

Investment Interest Expense Deduction

7

Disallowed investment interest expense to be carried forward to 2016. Subtract line 6 from

line 3. If zero or less, enter -0- .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Investment interest expense deduction. Enter the smaller of line 3 or 6. See instructions .

.

8

4952

For Paperwork Reduction Act Notice, see page 4.

Form

(2015)

Cat. No. 13177Y

1

1 2

2 3

3 4

4