Instructions For San Francisco Paid Parental Leave Form - 2016 Page 2

ADVERTISEMENT

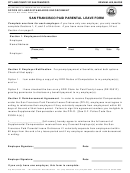

Employer

Normal Gross Weekly Wage

Average Weekly Tips

1 GSA BAKERY

500

2 CON COFFEE

600

203

Option B. Fill out your information on your earnings from all employers over the past 3 months or 12

weeks based on your pay stubs or other records. Enter the date and pre-tax earnings for each pay period.

You should include the reported tips from each employer in the column titled “Tips” if you receive

reported tips at any of these jobs. Do not include pay periods where you were on unpaid or partially paid

leave. For example, if you were on pregnancy disability leave and were only receiving partial pay, do not

include those amounts.

Note that your employer may request proof of wages from other employers.

Below is an example of an employee who has one employer with that pays the same wages each for each

bi-weekly pay period and one employer with fluctuating wages where the employee also receives tips.

Employer 1: GSA BAKERY

Employer 2: CON COFFEE

Bi-Weekly

Weekly

Date

Wages

Tips

Date

Wages

Tips

Pay Period

Pay Period

1

31-Dec

500

1

24-Dec

644

220

2

14-Jan

2

31-Dec

620

167

3

28-Jan

3

7-Jan

611

201

4

11-Feb

4

14-Jan

510

241

5

25-Feb

5

21-Jan

687

181

6

11-Mar

6

28-Jan

495

191

7

7

4-Feb

616

141

8

8

11-Feb

645

232

9

9

18-Feb

479

187

10

10

25-Feb

630

209

11

11

4-Mar

610

237

12

12

11-Mar

653

229

Once you have completed the earnings grids, sign and date the form and return it to each employer.

[DEC 2016 REV]

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4