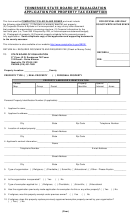

Form CR-NBH Instructions

Filing for Exemption

Use of Information

No property will be exempt from taxa-

tion under Minnesota Statute 272.02

Minnesota Statutes 272.02, subdivision

The information on this form is

if the taxpayer claiming the exemption

90 provides a property tax exemption to

required by Minnesota Statutes, sec-

knowingly violates any of the provisions

qualifying nursing homes and boarding

tion 272.02 to properly identify you

of this section.

care homes. The facility must be exempt

and determine if you qualify for this

from federal income taxation pursu-

property tax exemption. If you do not

Assessor May Request

ant to section 501(c)(3) of the Internal

provide the required information, your

Additional Information

Revenue Code, and must meet one of

application may be delayed or denied.

Upon written request by the assessor,

the following requirements:

Your County Assessor may also ask for

taxpayers must make available to the

• The facility is certified to participate

additional verification of qualifications.

assessor all necessary books and records

in the medical assistance program

Penalties

relating to the ownership or use of

under title 19 of the Social Security

Making false statements on this ap-

property which can help verify whether

Act; or

plication is against the law. Minnesota

or not the property qualifies for exemp-

• The facility certifies that it does not

Statutes, section 609.41 states that any-

tion.

discharge residents due to the inabil-

one giving false information in order to

Sale or Purchase of

ity to pay.

avoid or reduce their tax obligations is

Exempt Property

subject to a fine of up to $3,000 and/or

Applications are due February 1of the

up to one year in prison.

Property which is exempt from prop-

assessment year. This application must

erty tax on January 2 and, due to sale or

be re-filed every third year. No matter

Questions?

other reason, loses its exemption prior

what year the taxpayer initially files for

Contact your County Assessor’s Office

to July 1 of that year, will be placed on

exemption, applications will again be

for assistance.

the current assessment rolls for that

due in 2016, 2019, 2022, etc.

year.

In cases of sickness, absence, disability

The valuation will be determined with

or for other good cause, the assessor

respect to its value on January 2 of such

may extend the deadline for filing the

year. The classification will be based on

statement of exemption for a period not

the use to which the property was put

to exceed 60 days.

by the purchaser, or

Required Documentation

in the event the purchaser has not uti-

You must provide the following docu-

lized the property by July 1, the intend-

mentation with this application:

ed use of the property, as determined

• A designation from the IRS proving

by the county assessor, based upon all

status as a 501(c)(3) organization; and

relevant facts.

either

• a copy of the facility’s discharge

policy showing that residents are not

discharged due to the inability to pay;

or

• proof that the facility is certified to

participate in the medical assistance

program under title 19 of the Social

Security Act.

1

1 2

2