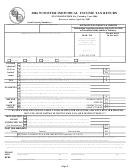

Rota Individual Income Tax Return Page 3

Download a blank fillable Rota Individual Income Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Rota Individual Income Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

37F05C

A COPY OF ALL APPROPRIATE FEDERAL SCHEDULES ARE REQUIRED IF COMPLETING SCHEDULE J.

SCHEDULE J

SUMMARY OF NON W-2 INCOME (For columns 2-5 enter the Municipality where the income was earned)

COLUMN 5

COLUMN 6

Print the name of each

COLUMN 1

COLUMN 2

COLUMN 3

COLUMN 4

TAXED BY A

ADD COLUMNS

municipality where a profit/

RESIDENCE MUNICIPALITY

NONTAXING MUNICIPALITY

RITA MUNICIPALITY OF

RITA MUNICIPALITY OF

NON-RITA MUNICIPALITY

1, 2, 3, 4 and 5

(loss) was earned in the

11

12

13

14

15

appropriate box(es)

21

22

23

24

25

23. From Federal

SCHEDULE C Attached

31

32

33

34

35

24. From Federal

SCHEDULE E Attached*

41

42

43

44

45

25. All Other Taxable Income

(or Loss). Attach Schedule(s)

26.

TOTAL NON-WAGE

INCOME

(Add Lines 23, 24, 25)

51

52

53

54

55

(

) (

) (

) (

) (

)

27. LESS LOSS CARRY

FORWARD if allowable

61

62

28. WORKPLACE INCOME

(Line 26 minus Line 27)

63

64

65

29. WORKPLACE INCOME

(Line 26 minus Line 27)

Column 6, Line 28 or Line 29 cannot be

30. MUNICIPAL TAX DUE

less than zero. If amount is less than

(NOTE:

Line 30 cannot be

zero, use zero.

less than zero.)

TOTAL of Column 6, place the total in Section B, Line 1b.

31.

NOTE: If any columns on Line 29 have entries complete Schedule K, Line 34.

*S-Corporation Distributions - Special Rules Apply - See Instructions

SCHEDULE K

To complete Schedule K, see page 6 of the instructions. If additional space is needed, use separate sheet.

32.

W-2 WAGES EARNED IN A RITA MUNICIPALITY OTHER THAN YOUR RESIDENCE MUNICIPALITY FROM WHICH

NO MUNICIPAL INCOME TAX WAS WITHHELD BY EMPLOYER. Complete Lines below.

Tax Rate

Wages

Municipality

Tax due

(see instructions)

Enter total tax due onto Line 32 and in Section B, Line 10.

32.

33.

W-2 WAGES EARNED IN A NON-RITA TAXING MUNICIPALITY AND FROM WHICH NO MUNICIPAL INCOME TAX WAS

WITHHELD BY EMPLOYER. (ONLY USE THIS SECTION IF YOU HAVE FILED AND PAID THE TAX DUE TO YOUR

WORKPLACE MUNICIPALITY. PROOF OF PAYMENT MAY BE REQUIRED) Complete Lines Below.

Tax Rate

Wages

Municipality

Tax due

(see instructions)

Enter total tax due onto Line 33

33.

34.

TAX DUE TO OTHER THAN RESIDENCE MUNICIPALITY ON NON W-2 INCOME REPORTED IN SCHEDULE J, LINE 29,

COLUMNS 3, 4, AND 5. Complete Lines below.

Workplace Income

Tax Rate

Municipality

Tax due

(Line 29, Columns 3, 4, & 5)

(see instructions)

Enter total tax due onto Line 34

34.

35.

TOTAL LINES 32, 33 AND 34. Enter total on Line 35 and in Section B, Line 4b.

35.

36.

FROM SCHEDULE J ABOVE, ADD LINE 30 COLUMNS 3 AND 4.

Enter total on Line 36 and in Section B, Line 11.

36.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3