Instructions For Form 1028

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

Instructions for Form 1028

(Revised March 1994)

Application for Recognition of Exemption

Under Section 521 of the Internal Revenue Code

Section references are to the Inter nal Revenue Code unless otherwise noted.

Make sure the application is complete.

persons with similar occupations that is

organized and operated on a cooperative

basis.

Please note. . .

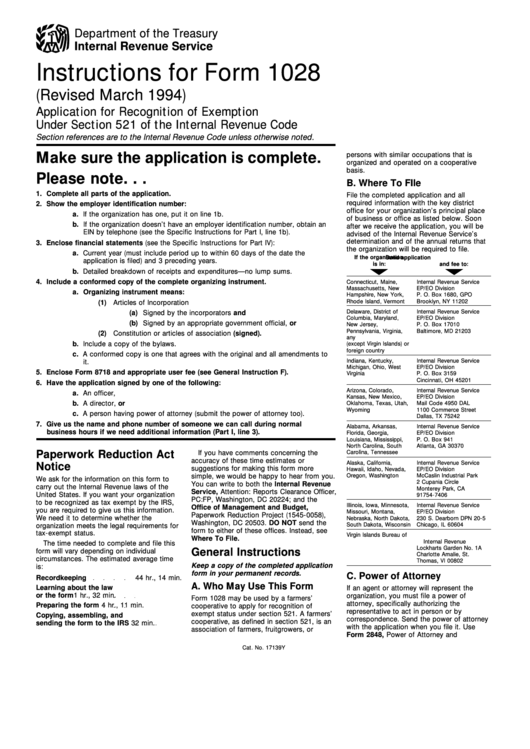

B. Where To FIle

1. Complete all parts of the application.

File the completed application and all

required information with the key district

2. Show the employer identification number:

office for your organization’s principal place

a. If the organization has one, put it on line 1b.

of business or office as listed below. Soon

b. If the organization doesn’t have an employer identification number, obtain an

after we receive the application, you will be

EIN by telephone (see the Specific Instructions for Part I, line 1b).

advised of the Internal Revenue Service’s

determination and of the annual returns that

3. Enclose financial statements (see the Specific Instructions for Part IV):

the organization will be required to file.

a. Current year (must include period up to within 60 days of the date the

If the organization

Send application

application is filed) and 3 preceding years.

is in:

and fee to:

b. Detailed breakdown of receipts and expenditures—no lump sums.

4. Include a conformed copy of the complete organizing instrument.

Connecticut, Maine,

Internal Revenue Service

Massachusetts, New

EP/EO Division

a.

Organizing instrument means:

Hampshire, New York,

P. O. Box 1680, GPO

Rhode Island, Vermont

Brooklyn, NY 11202

(1) Articles of Incorporation

Delaware, District of

Internal Revenue Service

(a) Signed by the incorporators and

Columbia, Maryland,

EP/EO Division

(b) Signed by an appropriate government official, or

New Jersey,

P. O. Box 17010

Pennsylvania, Virginia,

Baltimore, MD 21203

(2) Constitution or articles of association (signed).

any U.S. Possession

b. Include a copy of the bylaws.

(except Virgin Islands) or

foreign country

c. A conformed copy is one that agrees with the original and all amendments to

Indiana, Kentucky,

Internal Revenue Service

it.

Michigan, Ohio, West

EP/EO Division

5. Enclose Form 8718 and appropriate user fee (see General Instruction F).

Virginia

P. O. Box 3159

Cincinnati, OH 45201

6. Have the application signed by one of the following:

Arizona, Colorado,

Internal Revenue Service

a. An officer,

Kansas, New Mexico,

EP/EO Division

b. A director, or

Oklahoma, Texas, Utah,

Mail Code 4950 DAL

Wyoming

1100 Commerce Street

c. A person having power of attorney (submit the power of attorney too).

Dallas, TX 75242

7. Give us the name and phone number of someone we can call during normal

Alabama, Arkansas,

Internal Revenue Service

business hours if we need additional information (Part I, line 3).

Florida, Georgia,

EP/EO Division

Louisiana, Mississippi,

P. O. Box 941

North Carolina, South

Atlanta, GA 30370

Paperwork Reduction Act

If you have comments concerning the

Carolina, Tennessee

accuracy of these time estimates or

Alaska, California,

Internal Revenue Service

Notice

suggestions for making this form more

Hawaii, Idaho, Nevada,

EP/EO Division

simple, we would be happy to hear from you.

Oregon, Washington

McCaslin Industrial Park

We ask for the information on this form to

2 Cupania Circle

You can write to both the Internal Revenue

carry out the Internal Revenue laws of the

Monterey Park, CA

Service, Attention: Reports Clearance Officer,

United States. If you want your organization

91754-7406

PC:FP, Washington, DC 20224; and the

to be recognized as tax exempt by the IRS,

Illinois, Iowa, Minnesota,

Internal Revenue Service

Office of Management and Budget,

you are required to give us this information.

Missouri, Montana,

EP/EO Division

Paperwork Reduction Project (1545-0058),

We need it to determine whether the

Nebraska, North Dakota,

230 S. Dearborn DPN 20-5

Washington, DC 20503. DO NOT send the

organization meets the legal requirements for

South Dakota, Wisconsin

Chicago, IL 60604

form to either of these offices. Instead, see

tax-exempt status.

U.S. Virgin Islands

Virgin Islands Bureau of

Where To File.

Internal Revenue

The time needed to complete and file this

Lockharts Garden No. 1A

General Instructions

form will vary depending on individual

Charlotte Amalie, St.

circumstances. The estimated average time

Thomas, VI 00802

Keep a copy of the completed application

is:

form in your permanent records.

C. Power of Attorney

Recordkeeping

44 hr., 14 min.

A. Who May Use This Form

Learning about the law

If an agent or attorney will represent the

or the form

1 hr., 32 min.

organization, you must file a power of

Form 1028 may be used by a farmers’

attorney, specifically authorizing the

Preparing the form

4 hr., 11 min.

cooperative to apply for recognition of

representative to act in person or by

exempt status under section 521. A farmers’

Copying, assembling, and

correspondence. Send the power of attorney

cooperative, as defined in section 521, is an

sending the form to the IRS

32 min.

with the application when you file it. Use

association of farmers, fruitgrowers, or

Form 2848, Power of Attorney and

Cat. No. 17139Y

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2