Instructions For Form St-3al - Minnesota Department Of Revenue

ADVERTISEMENT

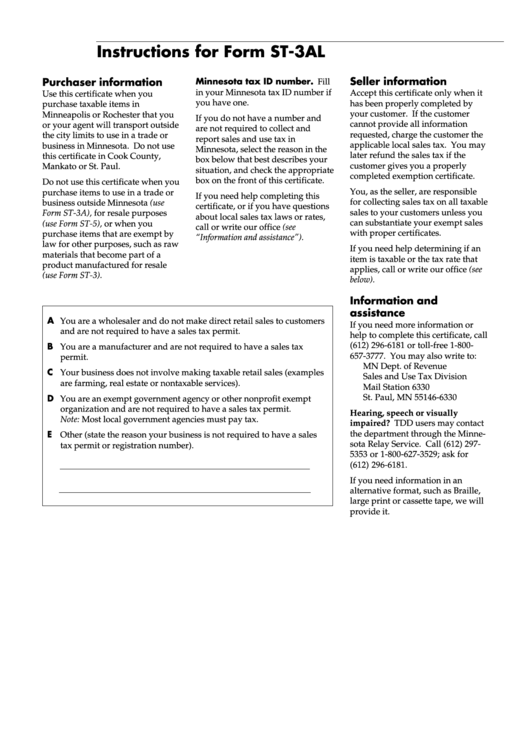

Instructions for Form ST-3AL

Seller information

Purchaser information

Minnesota tax ID number. Fill

in your Minnesota tax ID number if

Accept this certificate only when it

Use this certificate when you

you have one.

has been properly completed by

purchase taxable items in

your customer. If the customer

Minneapolis or Rochester that you

If you do not have a number and

cannot provide all information

or your agent will transport outside

are not required to collect and

requested, charge the customer the

the city limits to use in a trade or

report sales and use tax in

applicable local sales tax. You may

business in Minnesota. Do not use

Minnesota, select the reason in the

later refund the sales tax if the

this certificate in Cook County,

box below that best describes your

customer gives you a properly

Mankato or St. Paul.

situation, and check the appropriate

completed exemption certificate.

box on the front of this certificate.

Do not use this certificate when you

You, as the seller, are responsible

purchase items to use in a trade or

If you need help completing this

for collecting sales tax on all taxable

business outside Minnesota (use

certificate, or if you have questions

sales to your customers unless you

Form ST-3A), for resale purposes

about local sales tax laws or rates,

can substantiate your exempt sales

(use Form ST-5), or when you

call or write our office (see

with proper certificates.

purchase items that are exempt by

“Information and assistance”).

law for other purposes, such as raw

If you need help determining if an

materials that become part of a

item is taxable or the tax rate that

product manufactured for resale

applies, call or write our office (see

(use Form ST-3).

below).

Information and

assistance

A You are a wholesaler and do not make direct retail sales to customers

If you need more information or

and are not required to have a sales tax permit.

help to complete this certificate, call

(612) 296-6181 or toll-free 1-800-

B You are a manufacturer and are not required to have a sales tax

657-3777. You may also write to:

permit.

MN Dept. of Revenue

C Your business does not involve making taxable retail sales (examples

Sales and Use Tax Division

are farming, real estate or nontaxable services).

Mail Station 6330

St. Paul, MN 55146-6330

D You are an exempt government agency or other nonprofit exempt

organization and are not required to have a sales tax permit.

Hearing, speech or visually

Note: Most local government agencies must pay tax.

impaired? TDD users may contact

the department through the Minne-

E Other (state the reason your business is not required to have a sales

sota Relay Service. Call (612) 297-

tax permit or registration number).

5353 or 1-800-627-3529; ask for

(612) 296-6181.

If you need information in an

alternative format, such as Braille,

large print or cassette tape, we will

provide it.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1