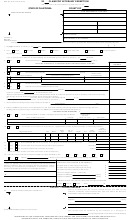

Claim For Home Exemption Page 2

Download a blank fillable Claim For Home Exemption in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Claim For Home Exemption with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

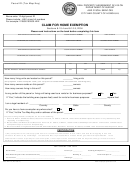

HOME EXEMPTION REQUIREMENTS

The real property is owned and occupied as the owner's principal home as of the assessment date by an individual or

individuals. Owner's principal home means occupancy of a home in the city with the intent to reside in the city. Intent to

reside in the city may be evidenced by, but not limited to, the following factors: occupancy of a home in the city for more than

270 calendar days of a calendar year; registering to vote in the city; being stationed in the city under military orders of the

United States; and filing an income tax return as a resident of the State of Hawaii, with a reported address in the city.

th

Your ownership must be recorded at the Bureau of Conveyances on or before September 30

proceeding the tax year for

which such exemption is claimed.

You file the claim for homeowner exemption with the Real Property Assessment Division (RPAD), Department of Budget and

th

Fiscal Services, City and County of Honolulu, on or before September 30

preceding the tax year for which such exemption is

claimed. Once exemption claim is accepted and approved for applied principal home, no additional home exemption filing is

required.

If you are a lessee with a lease that has a term of five or more years and the parcel is used for residential purposes, the lease

and any extension, renewal, assignment or agreement to assign the lease has been recorded at the Bureau of Conveyance,

and the lessee agrees to pay all real property taxes during the term of the lease, you may qualify for the home exemption.

SOCIAL SECURITY NUMBER

The social security number is requested for the purpose of verifying the identity of the claimant. The request is authorized

under the Federal Social Security Act (42 U.S.C.A. Sec. 405(c)(2)(C)). Disclosure is voluntary and will not affect the

allowance of a claim for exemption, but failure to disclose may result in delays in determining eligibility. If disclosed for

purposes of this exemption, social security numbers will not be subject to public access.

INSTRUCTIONS

1. Proof of age required for home exemption: If applying in person, present proof of age for all applicants, such as

driver's license, state identification, birth certificate, or other government or legal document. If applying by mail, complete

the claim form and submit a photocopy for proof of age of all applicants, such as driver's license, state identification, birth

certificate, or other government or legal document.

2. If there is more than one living unit or building on this parcel, draw a plot plan below showing the location of the living unit

where the owner or owners reside and the other living units or buildings on the parcel.

3. Claim forms are also accepted at all Satellite City Halls. Claims submitted at Satellite City Halls need to be in duplicate.

4. Deliver or mail via (certified or registered) the claim form with supporting documentation to:

Real Property Assessment Division

Real Property Assessment Division

842 Bethel Street, Basement

1000 Uluohia Street #206

Honolulu, HI 96813

Kapolei, HI 96707

Telephone: (808) 768-3799

Telephone: (808) 768-3169

(NOTE: This claim cannot be filed by facsimile transmission. For a receipted copy, submit with a self addressed

stamped envelope.)

Additional claim forms are available at the Real Property Assessment Division, Satellite City Halls, and the City and

County of Honolulu’s website at

PLOT PLAN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2