4

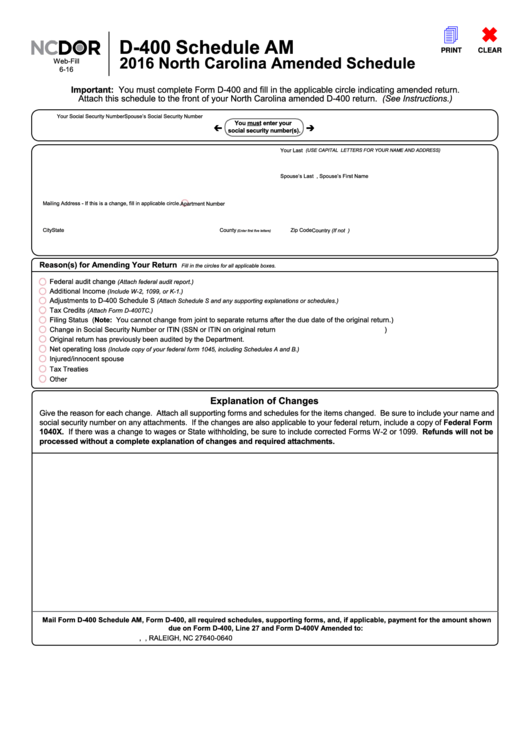

D-400 Schedule AM

PRINT

CLEAR

2016 North Carolina Amended Schedule

Web-Fill

6-16

Important: You must complete Form D-400 and fill in the applicable circle indicating amended return.

Attach this schedule to the front of your North Carolina amended D-400 return. (See Instructions.)

Your Social Security Number

Spouse’s Social Security Number

You must enter your

social security number(s).

Your First Name

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

M.I.

Your Last Name

If a Joint Return, Spouse’s First Name

M.I.

Spouse’s Last Name

Mailing Address - If this is a change, fill in applicable circle.

Apartment Number

City

State

Zip Code

Country (If not U.S.)

County

(Enter first five letters)

Reason(s) for Amending Your Return

Fill in the circles for all applicable boxes.

Federal audit change

(Attach federal audit report.)

Additional Income

(Include W-2, 1099, or K-1.)

Adjustments to D-400 Schedule S

(Attach Schedule S and any supporting explanations or schedules.)

Tax Credits

(Attach Form D-400TC.)

Filing Status (Note: You cannot change from joint to separate returns after the due date of the original return.)

Change in Social Security Number or ITIN (SSN or ITIN on original return

)

Original return has previously been audited by the Department.

Net operating loss

(Include copy of your federal form 1045, including Schedules A and B.)

Injured/innocent spouse

Tax Treaties

Other

Explanation of Changes

Give the reason for each change. Attach all supporting forms and schedules for the items changed. Be sure to include your name and

social security number on any attachments. If the changes are also applicable to your federal return, include a copy of Federal Form

1040X. If there was a change to wages or State withholding, be sure to include corrected Forms W-2 or 1099. Refunds will not be

processed without a complete explanation of changes and required attachments.

Mail Form D-400 Schedule AM, Form D-400, all required schedules, supporting forms, and, if applicable, payment for the amount shown

due on Form D-400, Line 27 and Form D-400V Amended to:

N.C. DEPARTMENT OF REVENUE, P.O. BOX 25000, RALEIGH, NC 27640-0640

1

1