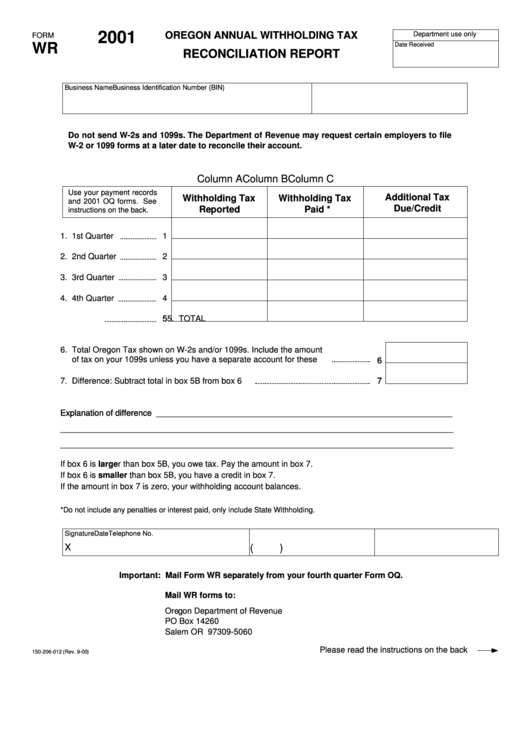

Form Wr, Oregon Annual Withholding Tax Reconciliation Report

ADVERTISEMENT

2001

OREGON ANNUAL WITHHOLDING TAX

Department use only

FORM

WR

Date Received

RECONCILIATION REPORT

Business Name

Business Identification Number (BIN)

Do not send W-2s and 1099s. The Department of Revenue may request certain employers to file

W-2 or 1099 forms at a later date to reconcile their account.

Column A

Column B

Column C

Use your payment records

Additional Tax

Withholding Tax

Withholding Tax

and 2001 OQ forms. See

Due/Credit

Reported

Paid *

instructions on the back.

1. 1st Quarter

1

2. 2nd Quarter

2

3. 3rd Quarter

3

4. 4th Quarter

4

5. TOTAL

5

5

6. Total Oregon Tax shown on W-2s and/or 1099s. Include the amount

of tax on your 1099s unless you have a separate account for these

6

6

7. Difference: Subtract total in box 5B from box 6

7

7

Explanation of difference ________________________________________________________________

Explanation of difference

_____________________________________________________________________________________

_____________________________________________________________________________________

If box 6 is larger than box 5B, you owe tax. Pay the amount in box 7.

If box 6 is smaller than box 5B, you have a credit in box 7.

If the amount in box 7 is zero, your withholding account balances.

*Do not include any penalties or interest paid, only include State Withholding.

Signature

Telephone No.

Date

X

(

)

Important: Mail Form WR separately from your fourth quarter Form OQ.

Mail WR forms to:

Oregon Department of Revenue

PO Box 14260

Salem OR 97309-5060

Please read the instructions on the back

150-206-012 (Rev. 9-00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1