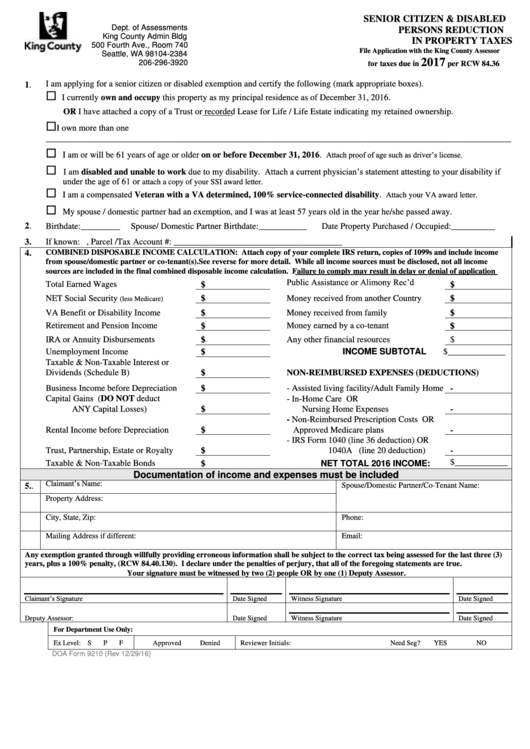

Senior Citizen And Disabled Persons Reduction In Property Taxes

ADVERTISEMENT

SENIOR CITIZEN & DISABLED

Dept. of Assessments

PERSONS REDUCTION

King County Admin Bldg

IN PROPERTY TAXES

500 Fourth Ave., Room 740

File Application with the King County Assessor

Seattle, WA 98104-2384

2017

206-296-3920

or taxes due in

per RCW 84.36

f

I am applying for a senior citizen or disabled exemption and certify the following (mark appropriate boxes).

1.

I currently own and occupy this property as my principal residence as of December 31, 2016.

OR I have attached a copy of a Trust or recorded Lease for Life / Life Estate indicating my retained ownership.

I own more than one property. Please provide the address and location of all other properties ___________________________

_________________________________________________________________________________________________________

Attach proof of age such as driver’s license.

I am or will be 61 years of age or older on or before December 31, 2016.

I am disabled and unable to work due to my disability. Attach a current physician’s statement attesting to your disability if

under the age of 61 or

attach a copy of your SSI award letter.

I am a compensated Veteran with a VA determined, 100% service-connected disability.

Attach your VA award letter.

My spouse / domestic partner had an exemption, and I was at least 57 years old in the year he/she passed away.

2.

Birthdate:_________

Spouse/ Domestic Partner Birthdate:___________

Date Property Purchased / Occupied:__________

3.

If known: , Parcel /Tax Account #: ______________________________________

4.

COMBINED DISPOSABLE INCOME CALCULATION: Attach copy of your complete IRS return, copies of 1099s and include income

from spouse/domestic partner or co-tenant(s). See reverse for more detail. While all income sources must be disclosed, not all income

sources are included in the final combined disposable income calculation.

Failure to comply may result in delay or denial of application

Public Assistance or Alimony Rec’d

Total Earned Wages

$

$

NET Social Security

Money received from another Country

$

$

(less Medicare)

VA Benefit or Disability Income

Money received from family

$

$

Retirement and Pension Income

$

Money earned by a co-tenant

$

IRA or Annuity Disbursements

$

Any other financial resources

$

Unemployment Income

INCOME SUBTOTAL

$_____________

$

Taxable & Non-Taxable Interest or

Dividends (Schedule B)

$

NON-REIMBURSED EXPENSES (DEDUCTIONS)

Business Income before Depreciation

- Assisted living facility/Adult Family Home

$

-

Capital Gains (DO NOT deduct

- In-Home Care OR

ANY Capital Losses)

Nursing Home Expenses

$

-

- Non-Reimbursed Prescription Costs OR

Rental Income before Depreciation

Approved Medicare plans

$

-

- IRS Form 1040 (line 36 deduction) OR

Trust, Partnership, Estate or Royalty

$

1040A (line 20 deduction)

-

$____________

NET TOTAL 2016 INCOME:

Taxable & Non-Taxable Bonds

$

Documentation of income and expenses must be included

Claimant’s Name:

Spouse/Domestic Partner/Co-Tenant Name:

5..

Property Address:

City, State, Zip:

Phone:

Mailing Address if different:

Email:

Any exemption granted through willfully providing erroneous information shall be subject to the correct tax being assessed for the last three (3)

years, plus a 100% penalty, (RCW 84.40.130). I declare under the penalties of perjury, that all of the foregoing statements are true.

Your signature must be witnessed by two (2) people OR by one (1) Deputy Assessor.

Claimant’s Signature

Date Signed

Witness Signature

Date Signed

Deputy Assessor:

Date Signed

Witness Signature

Date Signed

For Department Use Only:

Ex Level: S

P

F

Approved

Denied

Reviewer Initials:

Need Seg?

YES

NO

DOA Form 9210 (Rev 12/29/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2