Tax Form Checklist

ADVERTISEMENT

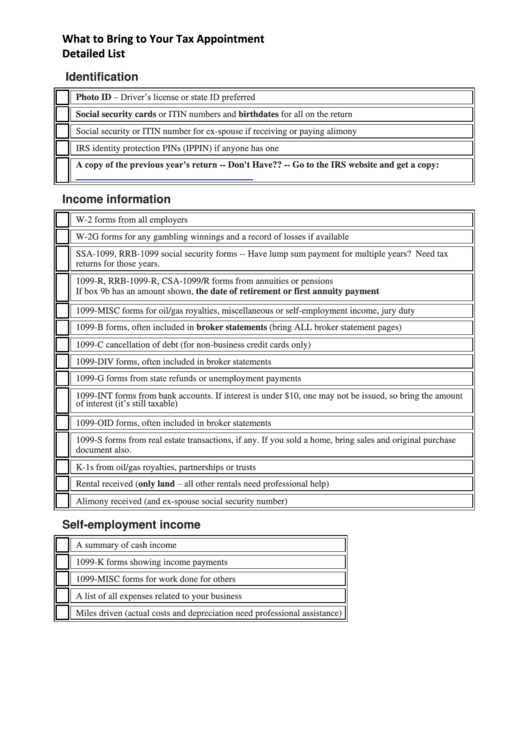

What to Bring to Your Tax Appointment

Detailed List

Identification

Photo ID – Driver’s license or state ID preferred

Social security cards or ITIN numbers and birthdates for all on the return

Social security or ITIN number for ex-spouse if receiving or paying alimony

IRS identity protection PINs (IPPIN) if anyone has one

A copy of the previous year’s return -- Don't Have?? -- Go to the IRS website and get a copy:

https://

Income information

W-2 forms from all employers

W-2G forms for any gambling winnings and a record of losses if available

SSA-1099, RRB-1099 social security forms -- Have lump sum payment for multiple years? Need tax

returns for those years.

1099-R, RRB-1099-R, CSA-1099/R forms from annuities or pensions

If box 9b has an amount shown, the date of retirement or first annuity payment

1099-MISC forms for oil/gas royalties, miscellaneous or self-employment income, jury duty

1099-B forms, often included in broker statements (bring ALL broker statement pages)

1099-C cancellation of debt (for non-business credit cards only)

1099-DIV forms, often included in broker statements

1099-G forms from state refunds or unemployment payments

1099-INT forms from bank accounts. If interest is under $10, one may not be issued, so bring the amount

of interest (it’s still taxable)

1099-OID forms, often included in broker statements

1099-S forms from real estate transactions, if any. If you sold a home, bring sales and original purchase

document also.

K-1s from oil/gas royalties, partnerships or trusts

Rental received (only land – all other rentals need professional help)

Alimony received (and ex-spouse social security number)

Self-employment income

A summary of cash income

1099-K forms showing income payments

1099-MISC forms for work done for others

A list of all expenses related to your business

Miles driven (actual costs and depreciation need professional assistance)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2