Page 2

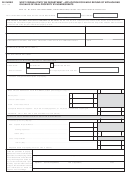

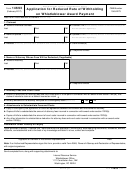

Instructions for Application for Reduced Rate of Withholding on Whistleblower Award

Payment, Form 14693

Use this form ONLY if you have been notified that you are due to receive a whistleblower award under Section 7623(b)

and you want to reduce the rate of withholding on the award. To be considered for a reduced withholding rate, the

application (Form14693) must be received by the Whistleblower Office within 30 days from the date printed on the form.

Please read the instructions before completing the form.

Claimant

Enter the last name, first name, and middle initial of the claimant

1a.

1b.

Enter the last, first and middle initial of the claimant’s spouse, if applicable

Enter address information

1c.

Enter the last four digits of the Claimant’s Identification Number (SSN, ITIN, etc)

1d.

Enter the claim numbers

1e.

1f.

Enter the phone number

Attorney

Enter the last name, first name, and middle initial of the attorney whose fees will be deducted

2a.

Enter address information

2b.

Enter the phone number

2c.

Attorney Fees and Court Costs

Enter the dollar amount you intend to deduct on your tax return for (a) Attorney Fees and (b) Court Costs

3.

Attach Documents to Substantiate Attorney Fees and Court Costs

4a.

Agreement between claimant and attorney

Bills of attorney fees

4b.

Bills of court costs

4c.

Other documents to support attorney fees and court costs

4d.

Declaration Section

The claimant or his or her authorized representative may sign the declaration statement. This request will not be

considered complete or valid if the declaration statement is not signed with an original signature and date. If signed by an

authorized representative, provide a valid Form 2848, Power of Attorney and Declaration of Representative, with original

signatures and date.

14693

Catalog Number 67566P

Form

(2-2017)

1

1 2

2